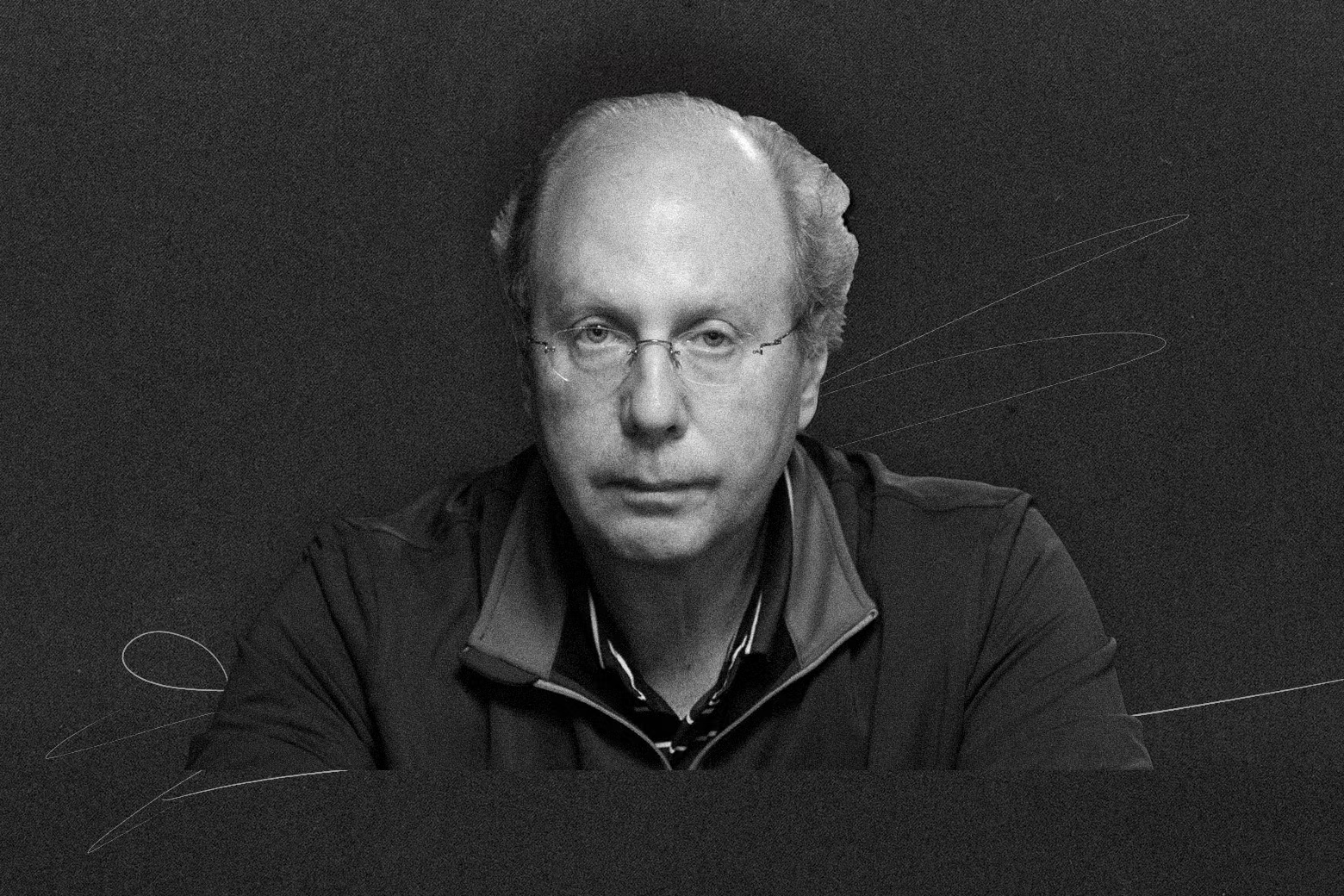

Are you interested in the world of venture capital? Do you want to learn about it from someone who has been a key player in the industry for decades? Look no further than Jeff Yass, a renowned financial expert and founder of Susquehanna International Group. In this article, we’ll delve into Jeff’s insights and perspectives on venture capital, giving you an insider’s look at this exciting and ever-evolving field. Whether you’re considering investing or simply curious about how venture capital works, Jeff Yass has the knowledge and experience to guide us through it all. So let’s get started and see what he has to say about the world of venture capital!

So, What Jeff Yass thinks about venture capital?

According to Jeff Yass, a successful venture capitalist and co-founder of the trading firm Susquehanna International Group, the key to successful investing in startups is having a deep understanding of the industry and its potential for growth. He believes that it’s not just about throwing money at an idea, but rather carefully analyzing market trends and evaluating the team behind the business.

Yass also stresses the importance of patience when it comes to investing in startups. He acknowledges that not every investment will be a success, but by taking calculated risks and being patient with returns, one can see significant gains in their portfolio.

Furthermore, Yass emphasizes the value of mentorship in venture capital. He believes that experienced investors should guide younger ones through their first investments and help them navigate through any challenges they may face along the way.

Overall, Jeff Yass brings a unique perspective as both an insider in venture capital and someone who has seen great success in this field. His insights serve as valuable lessons for anyone looking to enter or excel in this competitive industry.

Jeff Yass’s Background and Entrance into Venture Capital

Jeff Yass, one of the most successful venture capitalists in the world, has an interesting and unconventional background that led him to his current career path. Born and raised in a middle-class family in Philadelphia, Yass had a deep interest in mathematics and statistics from a young age. He excelled in these subjects throughout his schooling and eventually went on to study finance at the University of Pennsylvania.

After graduation, Yass worked as a trader on Wall Street for a few years before realizing it was not where he wanted to be long-term. In 1989, he left his job to pursue his passion for trading options full-time. This decision proved to be incredibly lucrative for Yass as he quickly became very successful and established himself as one of the top traders in the field.

In 1997, Yass made another bold move by co-founding Susquehanna International Group (SIG), an options trading firm based out of Bala Cynwyd, Pennsylvania. With his expertise and innovative strategies, SIG flourished into one of the largest private financial firms in the world with over $500 billion worth of transactions per year.

Yass’s success with SIG caught the attention of many prominent investors who were eager to work with him. This led him into venture capital where he invested heavily in startups such as Google and Facebook early on, reaping massive returns for himself and other investors.

Today, Jeff Yass continues to actively invest through both SIG and his own personal investment firm called Alpha Strategies Investment Group. His unique background has given him valuable insights into predicting market trends which have contributed greatly to his success as both a trader and venture capitalist.

Understanding Jeff Yass’s Perspective on the Role of Venture Capital in Startups

Jeff Yass, an esteemed Wall Street trader and founder of Susquehanna International Group, has profound insights when it comes to the intersection of venture capital and startups. In his eyes, venture capital is more than just a financial instrument; it’s the lifeblood that keeps the startup ecosystem thriving and resilient.

To him, venture capitalists are akin to talented gardeners who nurture seeds (startups) into fully bloomed flowers (successful businesses). It’s not just about pouring in money. Instead, they guide fledgling companies towards sustainable growth with strategic advice, industry connections and mentorship.

- The first step, he believes, should be finding a compelling idea that has the potential to disrupt existing markets or create entirely new ones.

- The second step, involves shaping this rough diamond into a viable business model.

- The third stage, as per Yass’s philosophy constitutes actively seeking out venture capital while keeping in mind that this is not merely transactional but rather a partnership where both parties stand to gain substantially from success.

This approach underscores Jeff Yass’s belief on how Venture Capitalists (VCs) play pivotal roles beyond providing monetary funding – they form symbiotic relationships with entrepreneurs guiding them through their journey creating successful enterprises capable of changing our world for better.

Read also: joint ventures in Soft drinks manufacturing industry

How Jeff Yass Interprets The Risk And Reward Dynamic Of Venture Capital

Jeff Yass, a renowned figure in the venture capital world, has a unique approach to unraveling the risk and reward dynamics inherent in this high-stakes arena. His strategy is all about balancing careful analysis with well-measured boldness—an equilibrium that can only be achieved through years of experience and keen insight. He doesn’t shy away from risk; rather, he embraces it head-on but does so intelligently.

Yass’s methodology involves evaluating potential investments based on a multitude of factors, such as historical trends, company valuation, industry landscape and future growth potential. But beyond these traditional considerations are other more nuanced variables – ones that most investors might overlook or underestimate:

- Mental agility: The ability to pivot when things don’t go as planned is key for any startup.

- Innovation quotient: How capable is the company at creating disruptive products or ideas?

- Cultural fit: Will the business blend seamlessly into its intended market?

And there’s much more! Jeff believes that understanding these complex layers not only mitigates risk but also magnifies rewards by uncovering hidden gems among startups. To him, each investment opportunity presents an intricate puzzle; solving it requires deep thoughtfulness balanced with sharp instinct—a true embodiment of his interpretation of venture capital’s risk vs reward dynamic.

Insights from Jeff Yass: Finding the Right Balance in a Venture Capital Deal

The world of venture capital is an intricate one, with many variables at play. One requires a keen sense of discernment and negotiation to navigate successfully through it. Jeff Yass, the renowned options trader and founder of Susquehanna International Group, offers insightful advice on striking the right balance in a venture capital deal. He emphasizes the importance of maintaining equity, ensuring what is fair for both parties involved. According to him, tilting too much towards either side might result in losing out or exploiting opportunities.

Venture capitalists require sharp instincts to evaluate prospects accurately; they need to consider not only financials but also product viability, market demand, and management team capabilities.

Here are some key pointers from Yass’s approach:

- Valuing companies appropriately: This requires extensive research about the industry norms alongside thorough analysis of company-specific factors like growth potential.

- Negotiating terms that suit both sides: It’s vital not just to assure returns for investors but also support entrepreneurs’ vision and their ability to execute it.

- Maintaining healthy investor relations: Open communication lines offer confidence in managing any unforeseen circumstances during the investment period.

Jeff stresses that balance isn’t merely about numbers but understanding human dynamics involved – building trustful relationships while keeping sight on business interests. His wisdom echoes true in today’s evolving venture capital landscape where collaboration takes precedence over competition.

What Jeff Yass thinks about venture capital

What Jeff Yass thinks about venture capital

You may also like: who are AbbVie’s joint venture partner

Key Takeaways From Jeff Yass For Aspiring Investors In The World Of Venture Capital

Learning from Legends

Jeff Yass, a legendary figure in the world of trading and investment, has much to impart to those who aspire to venture into this complex but rewarding arena. His wisdom is distilled from years of hands-on experience, where risk-taking and strategic thinking are paramount. By following his guidance, anyone eager to penetrate the highly competitive field of Venture Capital can gain valuable insights.

One key nugget from Mr. Yass’ vast repository of knowledge is understanding that ‘the market knows more than you do’. This means investors should not allow personal biases or emotions cloud their decisions; instead they should trust market indicators which reflect collective intelligence.

Another crucial piece of advice he often shares revolves around ‘taking calculated risks.’ Investing isn’t about playing it safe – it’s about taking measured chances for high returns. However, these risks must be well-researched and weighed against potential gains.

- Investing with humility: Acknowledging that everyone makes mistakes – even seasoned investors – allows one to learn and grow.

- Risk management: Balancing between risk and reward ensures sustainable success.

- Patient observation: Watching the market closely aids intelligent decision-making.

The Importance Of Strategy And Patience

In addition, Jeff stresses on adopting a long-term perspective when investing in startups. A great idea may take time to mature into a profitable business – patience truly becomes an investor’s best friend.

Equally important as per him would be ‘not putting all your eggs in one basket’. Diversification across different sectors helps mitigate losses during volatile periods while maximizing overall returns over time.

Lastly but perhaps most importantly advised by Mr.Yass is ensuring transparency with entrepreneurs we invest in such as clear communication regarding expectations on return on investments (ROI), exit strategies and potential pitfalls. Honest, open dialogues foster trust which is the bedrock of any successful business partnership.

- Long-term vision: This can yield rewards that far eclipse short-term gains.

- Diversification: It hedges against losses and enables better overall returns.

- Transparency: It lays the foundation for prosperous business relationships.

Conclusion: Reflecting on What We Can Learn from Jeff Yass’s Views On Venture Capital.

Jeff Yass, a formidable figure in the investment world and founder of Susquehanna International Group, holds insightful perspectives about venture capital that can potentially reshape our understanding. His approach, which deviates from the standard norms, emphasizes on scrutinizing each potential opportunity with an intense focus on long-term value rather than instant yields. As per his views,

- It’s not just about throwing money at promising startups; it’s about carefully evaluating their potential to transform into sustainable businesses.

- Venture capital should serve as a catalyst for innovation while ensuring financial viability.

Venture capitalists or anyone interested in investing can adopt Yass’ perspective. This would mean choosing to support startups only after thorough due diligence, assessing everything from organizational structure to market competition.

Moreover, these investors must become active participants by providing guidance and resources beyond mere fiscal support. According to Jeff Yass, it is this kind of strategic thinking that turns good ideas into successful businesses—a principle we can all apply regardless of whether we’re talking billion-dollar companies or small-scale start-ups. In summary, adopting this more holistic view towards venture capitalism certainly has many advantages—benefitting both entrepreneurs and investors alike—and serves as an effective guide in today’s competitive startup landscape.

Read also: best venture capital firms