Are you interested in learning about venture capital from the perspective of a successful billionaire investor? Look no further than this article! As someone who has made billions through investments, Jim Simons is an expert in the field of venture capital. In this article, we’ll explore some of his key insights and lessons learned from his experiences. Whether you’re a budding entrepreneur or simply curious about the world of investing, Jim Simons’ wisdom will be sure to provide valuable insights and inspiration. So let’s dive into the mind of a billionaire investor and see what we can learn about venture capital together!

So, Jim Simons on venture capital?

Venture capital is a type of investment that involves providing funding to startup companies and small businesses in exchange for equity or ownership in the company. It is a high-risk, high-reward form of investing that has gained popularity in recent years.

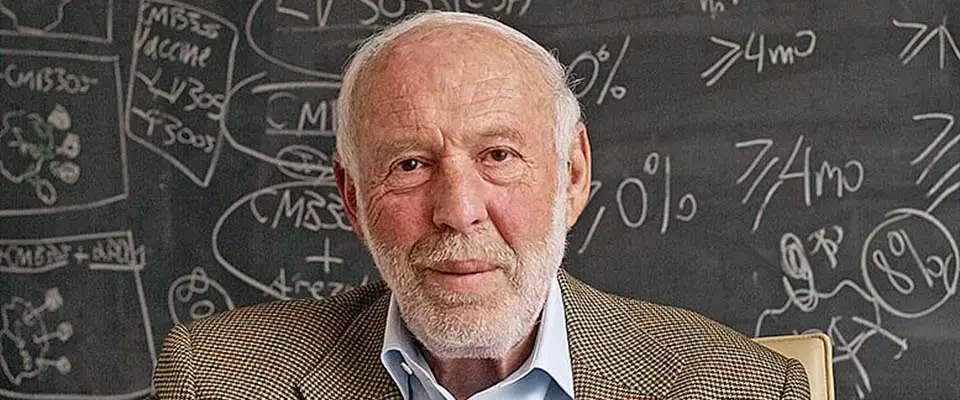

Jim Simons, a billionaire investor and founder of hedge fund Renaissance Technologies, has shared his insights on venture capital based on his experience as an early investor in tech giants like Google and Facebook.

One key piece of advice from Simons is to invest in people rather than just ideas. He believes that the success of a company ultimately depends on its team and their ability to execute their idea effectively. This means looking beyond just the product or service being offered and evaluating the leadership, skills, and passion of the founders.

Simons also stresses the importance of diversification when it comes to venture capital investments. While it can be tempting to put all your money into one promising startup, he advises spreading out investments across multiple companies to minimize risk.

Another valuable lesson from Simons is patience. He acknowledges that most startups will not see immediate success and may require several rounds of funding before becoming profitable. Therefore, it’s important for investors to have a long-term perspective and be willing to weather any initial challenges or setbacks.

In addition, Simons emphasizes staying updated on industry trends and constantly learning about new technologies. As an early investor in Silicon Valley during its rise as a tech hub, he understands the value of being ahead of the curve when it comes to emerging industries.

Overall, Jim Simons’ insights highlight the importance of thorough research, diversification, patience, and staying informed when it comes to successful venture capital investing. By following these principles along with having a strong intuition for potential growth opportunities, individuals can potentially achieve great returns through this dynamic form of investment.

Jim Simons’ Approach to Venture Capital

Jim Simons is a renowned mathematician, hedge fund manager, and philanthropist who has made significant contributions to the world of venture capital. His approach to investing in new and innovative ideas has revolutionized the industry and continues to pave the way for successful startups.

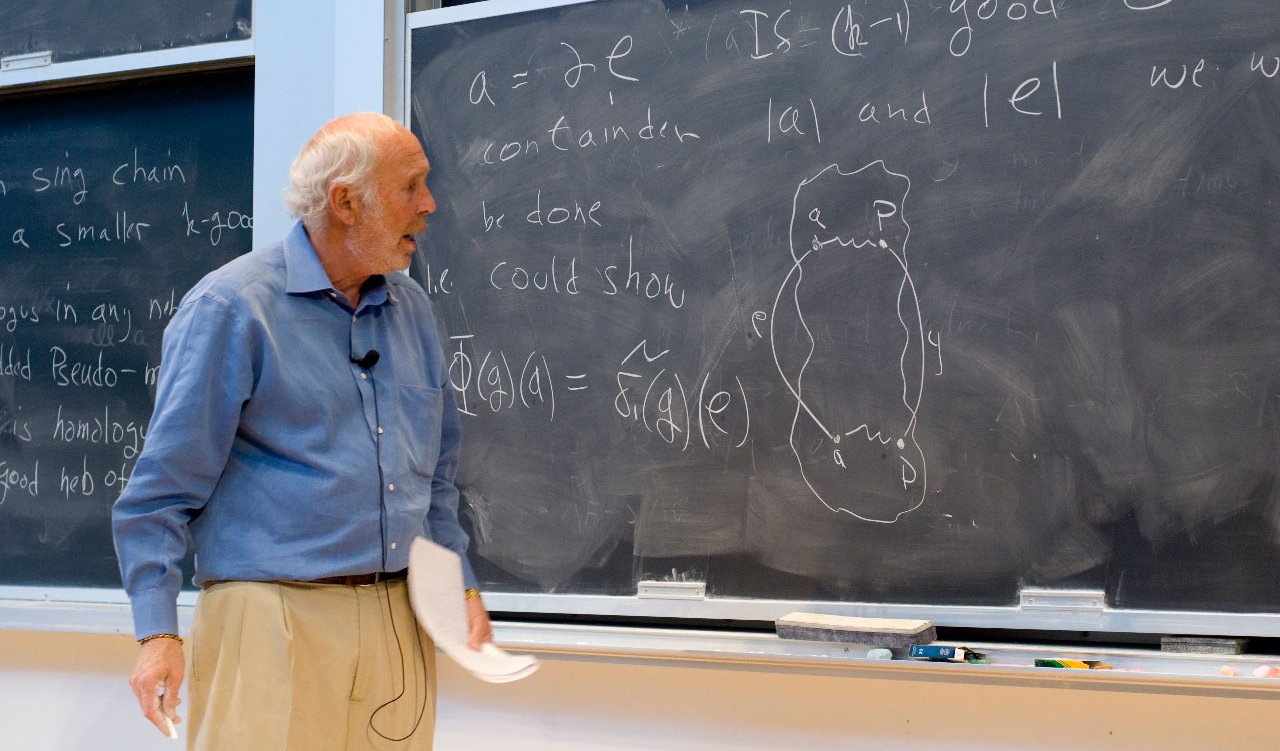

One key aspect of Simons’ approach is his focus on data-driven decision making. As a mathematician, he understands the importance of analyzing data and using it to inform investment decisions. This allows him to objectively evaluate potential investments based on their financial viability and market potential, rather than relying solely on intuition or personal connections. Additionally, Simons believes in continuously collecting data throughout the investment process, allowing for adjustments to be made as needed.

Another crucial element of Simons’ approach is his emphasis on teamwork and collaboration. He recognizes that successful ventures require a diverse team with different skill sets working together towards a common goal. This collaborative approach not only ensures that all aspects of an investment are thoroughly evaluated but also fosters an environment where creativity can flourish.

Furthermore, unlike many other venture capitalists who focus solely on maximizing profits, Jim Simons takes into account social impact when evaluating potential investments. He understands that businesses have a responsibility towards society and seeks out companies that align with his values of promoting education and scientific research.

In addition to these core principles, Jim Simons’ success can also be attributed to his long-term perspective when it comes to investing in startups. Rather than seeking quick returns, he takes a patient approach by investing in early-stage companies with promising futures ahead.

Overall, Jim Simons’ unique blend of data-driven decision making, teamwork mindset,and socially responsible investing has set him apart from other venture capitalists and solidified his reputation as one of the most influential figures in this field.

Keys to Successful Investing According to Jim Simons

Jim Simons, known for his mathematical genius and undeniable financial acumen, is one of the most successful investors in the world. His advice on investing isn’t just about numbers; it’s also about cultivating habits that will allow you to make informed decisions. His first key piece of advice is to nurture a constant thirst for knowledge. In other words, staying informed should be an investor’s top priority. This goes beyond merely reading business news or tracking market trends; it means digging deep into every industry or company you’re considering investing in.

- Research: It involves understanding what drives their revenue growth, identifying risks they might face, and figuring out how competitive their products are in the market.

- Analyze: Once this information has been collected, it must then be analyzed thoroughly. Look at the hard data but don’t ignore your gut feeling either.

- Evaluate: Finally, evaluate whether an investment aligns with your individual risk tolerance before making a decision.

Simons’ second crucial aspect of successful investing emphasizes on adopting a long-term perspective. Investing isn’t about scoring quick wins; rather, patience is often rewarded in this field.

In essence: buy-and-hold investments can pay off tremendously over time thanks to compound interest – “the eighth wonder of the world” as Einstein reportedly called it! For instance, stocks from companies like Apple and Amazon have shown spectacular gains for those who stuck around through thick and thin.

So while flash-in-the-pan success stories may seem enticing initially, Jim Simons advises keeping your eyes firmly fixed on the distant horizon – because“Rome wasn’t built in a day.”.

Read also: Who are Tencent’s joint venture partners?

Understanding Risk Assessment in Venture Capital with Jim Simons

Venture Capital, a form of private equity and a type of financing that investors provide to startups they believe have long-term growth potential, is both an exciting and risky business. One person who knows this field inside out is Jim Simons, renowned mathematician, philanthropist and the founder of Renaissance Technologies LLC – one of the world’s most successful hedge funds. He has spent decades perfecting his venture capital risk assessment skills in order to better navigate these turbulent investment waters.

Simons believes that understanding risk isn’t just about crunching numbers; it requires insight into the startup’s industry as well as its management team. For him, key factors that influence his decision are:

- The market size for the company’s product or service

- The competitive landscape

- The strength and adaptability of the management team

After contemplating these points, only then does he delve deeper into assessing other financial metrics such as projected revenue growth. Further, Jim Simons always maintains a diversified portfolio; this strategy assists in spreading risk evenly among different companies across various industries. In essence, Simons’ approach towards venture capital risk assessment combines detailed analysis with thoughtful human judgment—a blend resulting in outstanding success throughout his career.

Jim Simons’ Take on Identifying High-Potential Startups

Jim Simons, renowned mathematician and founder of the successful hedge fund, Renaissance Technologies, has an insightful perspective on identifying high-potential startups. His approach is grounded in thorough research and comprehensive analysis, viewing each startup as a unique entity with its own set of merits and potential pitfalls. He emphasizes the importance of product viability, which pertains to whether or not a product or service meets a significant need in the market. If it doesn’t offer something novel or significantly better than what’s currently available, it might struggle to make an impact.

Simons also highlights three other major factors:

- Team dynamics: According to him, having a team that communicates well and works cohesively towards common goals can be more important than just individual talent.

- Growth strategy: A company should have clear plans for expansion; otherwise sustainable success may prove elusive.

- Fiscal Responsibility: Startups must manage their finances meticulously because even great ideas fail due to poor financial management.

Simons’ methodology combines quantitative rigour with qualitative analysis. He strongly believes that while numbers are vital indicators of performance, they don’t always tell the complete story. Understanding the vision behind a startup and how this vision aligns with market trends is paramount in judging its potential for sustained growth.

Experts from various fields respect his views regarding identifying high-growth opportunities not only because he redefined investment strategies using advanced mathematical models but also by demonstrating exceptional acumen in recognizing promising ventures long before others can see their potential.

Jim Simons on venture capital

Jim Simons on venture capital

You may also like: What companies are partnering with Nvidia?

How Jim Simons Maneuvers Investment Failures and Challenges

Jim Simons, renowned mathematician turned billionaire hedge fund manager, has a distinct approach to maneuvering investment failures and challenges. He’s the mastermind behind Renaissance Technologies, one of the most successful quantitative trading firms in history. Unlike traditional investors who rely on intuition and market analysis, Simons adopted a scientific methodology that uses complex mathematical models to predict market fluctuations.

However, it’s not all smooth sailing for this Wall Street whiz. When faced with investments gone awry or financial hurdles, his strategies take an unorthodox turn.

Simons’ primary technique is adjusting his firm’s portfolio based on numbers rather than emotions or gut feelings – no matter how dire the situation may seem. This unique approach was seen during the financial crisis of 2008. While many panicked and made impulsive decisions resulting in significant losses, Simons remained composed by sticking strictly to his data-driven strategy.

- Rationality Over Emotion: Just as a seasoned sailor navigates through stormy seas with calm deliberation, so does Jim steer clear of emotional reactions when dealing with financial typhoons. For him, rational decision-making anchored in hard-core scientific data trumps knee-jerk emotional reactions.

- Persistence Despite Setbacks: Like any investor worth their salt knows – setbacks are part and parcel of investing endeavors; they’re simply unavoidable obstacles along the way towards tremendous success.

- Leveraging Failure as Learning Opportunities: To Simon’s credit, he views every failure not as defeats but stepping stones towards making better future decisions.

In conclusion,

navigating turbulent investment waters requires determination coupled with innovative problem-solving skills – traits that Jim Simons embodies perfectly while steering through financial challenges.

Conclusion: Applying Insights from Billionaire Investor, Jim Simons in Venture Capital

Venture capitalism can often appear like a high-stakes game of poker, where the outcome is uncertain and the bets are sky-high. But in this game, we have a secret weapon – insights from billionaire investor Jim Simons. Known for his mathematical approach to investing, Simons has established himself as one of the most successful investors in the world. His methods offer valuable lessons that can be applied to venture capital.

1: Embrace Data. In today’s data-driven era, understanding and interpreting numbers is more important than ever before. Simons’ background in mathematics allowed him to see patterns others missed and make decisions based on statistical probability instead of gut feelings or speculation.

2: Diversify Your Portfolio. Every savvy investor knows not to put all their eggs in one basket – or rather, not pinning all hopes on a single investment opportunity.

3: Take Calculated Risks.“The best time to take risk is when you’re young.”– This quote by Simons perfectly encapsulates his view on risk-taking.

- Data analysis allows for calculated risks.

- Diversification aids in mitigating hazards linked with potential failure points within investments.

An Investment Mindset, whether it’s venturing into uncharted territories or betting big on new industries, successful venture capitalists embrace an entrepreneurial mindset. They don’t shy away from taking risks but they do so wisely, analyzing every aspect meticulously before making a decision.

Above all else though,“You need some luck”, says Simon; proving again that while strategies and plans are essential tools for success – there’s always room for chance.

Applying insights from Jim Simons into Venture Capitalism isn’t about copying his every move – instead it’s about learning how he thinks and adapts that methodology into your own investment style. Keep a keen eye on the data, diversify with purpose, and embrace calculated risks while acknowledging the element of luck – these are lessons well worth applying.

Read also: career path to venture capital