Interested in venturing into the world of venture capital? You’re not alone. With the rise of startup culture and tech companies, more people are looking to invest in this exciting and potentially lucrative field. But before you dive in headfirst, it’s important to learn from those who have been there before. And who better to learn from than billionaire hedge fund manager David Tepper?

In this article, we’ll take a closer look at David Tepper’s insights on venture capital and what you need to know before investing your hard-earned money. From understanding the risks involved to finding the right opportunities, Tepper shares valuable advice for beginners looking to enter the world of venture capital. So let’s tap into his expertise and get started on our own successful investment journey!

So, David Tepper on venture capital?

Venture capital is a form of investment where individuals or firms provide funding to startups and small businesses that have high growth potential. This type of investment usually comes from experienced investors who are looking for a higher return on their money. David Tepper, a successful hedge fund manager, has shared his insights on venture capital and what you need to know before investing.

Firstly, it’s important to understand the risks involved in venture capital. Startups and small businesses are inherently risky investments as they often have unproven business models and may not generate profits for several years. As such, there is always a chance that your investment may not yield returns or even result in losses.

Secondly, it’s crucial to thoroughly research the company and its founders before investing. Look into their track record, experience in the industry, and their vision for the future of the business. It’s also important to assess whether there is a market demand for the product or service being offered by the startup.

Another key factor to consider is diversification. As with any type of investment, it’s wise to spread out your funds across different companies rather than putting all your eggs in one basket. This can help mitigate risks and increase your chances of success.

Additionally, having patience is essential when it comes to venture capital investments. Unlike stocks which can be bought and sold quickly, startups often require time to grow and become profitable. It could take several years before you see any returns on your initial investment.

Lastly, having an understanding of how venture capitalists operate can also be beneficial before diving into this type of investment opportunity. They typically look for companies with high potential for growth but also seek some level of control over decision-making within the company.

In conclusion, while venture capital can offer attractive returns if successful investments are made, it’s crucial to carefully assess risks and do thorough research before committing any funds. With proper due diligence and patience, this form of investment can be a valuable addition to an investment portfolio.

Understanding Venture Capital: Insights from David Tepper

Venture capital has become a buzzword in the business world, and for good reason. It is a form of financing that allows entrepreneurs to bring their innovative ideas to life by providing them with the necessary funding and resources. David Tepper, founder of Appaloosa Management and one of the most successful venture capitalists, has shared some valuable insights into this fascinating industry.

Firstly, it’s important to understand what venture capital really means. In simple terms, it is a type of private equity investment where investors provide funding to startups or small businesses that have high growth potential but are also high risk. This means that there is no guarantee for success, but if the company does succeed, the return on investment can be huge.

One of David Tepper’s key pieces of advice for aspiring entrepreneurs seeking venture capital is to focus on building strong relationships with potential investors rather than just pitching your idea. Building trust and credibility with investors takes time and effort, but it can greatly increase your chances of securing funding. Additionally, Tepper stresses the importance of having a solid business plan in place before approaching venture capitalists. A well-thought-out plan not only showcases your vision and goals but also highlights potential challenges and how you plan to overcome them.

Another crucial aspect highlighted by Tepper is finding the right fit when it comes to choosing an investor. Not all venture capitalists are created equal – they have different areas of expertise and interests which may align differently with your own goals as an entrepreneur. It’s essential to do thorough research on potential investors before deciding who you want on board as they will not only provide funds but also play a significant role in shaping your company’s future.

In conclusion, understanding venture capital from experts like David Tepper can give aspiring entrepreneurs invaluable insights into this complex yet rewarding field. From building strong relationships with investors to finding the right fit for your startup – these tips can help pave the way towards success.

Risk Assessment in Venture Capital: David Tepper’s Perspective

Venture Capitalist David Tepper has an impressive track record in the field. He’s known for his rigorous and effective approach to risk assessment, a critical aspect of venture capital investment that often determines the success or failure of these high-stakes endeavours. Risk assessment involves evaluating potential losses linked to uncertainties, such as market volatility and governance issues. Tepper‘s take on this concept is both unique and enlightening.

Tepper likens risk assessment in venture capital to navigating uncharted waters – it’s about steering your ship safely without completely avoiding the thrill of exploration. His approach combines savvy intuition with a keen understanding of data analytics:

- “You have to be comfortable with ambiguity,”

- “Always cross-check instincts with hard numbers.”

He teaches us that embracing uncertainty can lead to great rewards but only when complemented by diligent due diligence process which includes thorough analysis of various factors like company’s financial health, the business model, competitive environment etc.

David Tepper believes in being agile in response to changing landscapes while maintaining firm confidence in one’s decisions after careful consideration. He sums up his philosophy succinctly:

- “The best bets are those where you saw risks that no one else did – but managed them wisely.”

This perspective provides invaluable insight into risk management strategies which could determine whether an investment sinks or swims!

Read also: joint ventures in Media industry

Identifying Potential Investment Opportunities: Advice from David Tepper

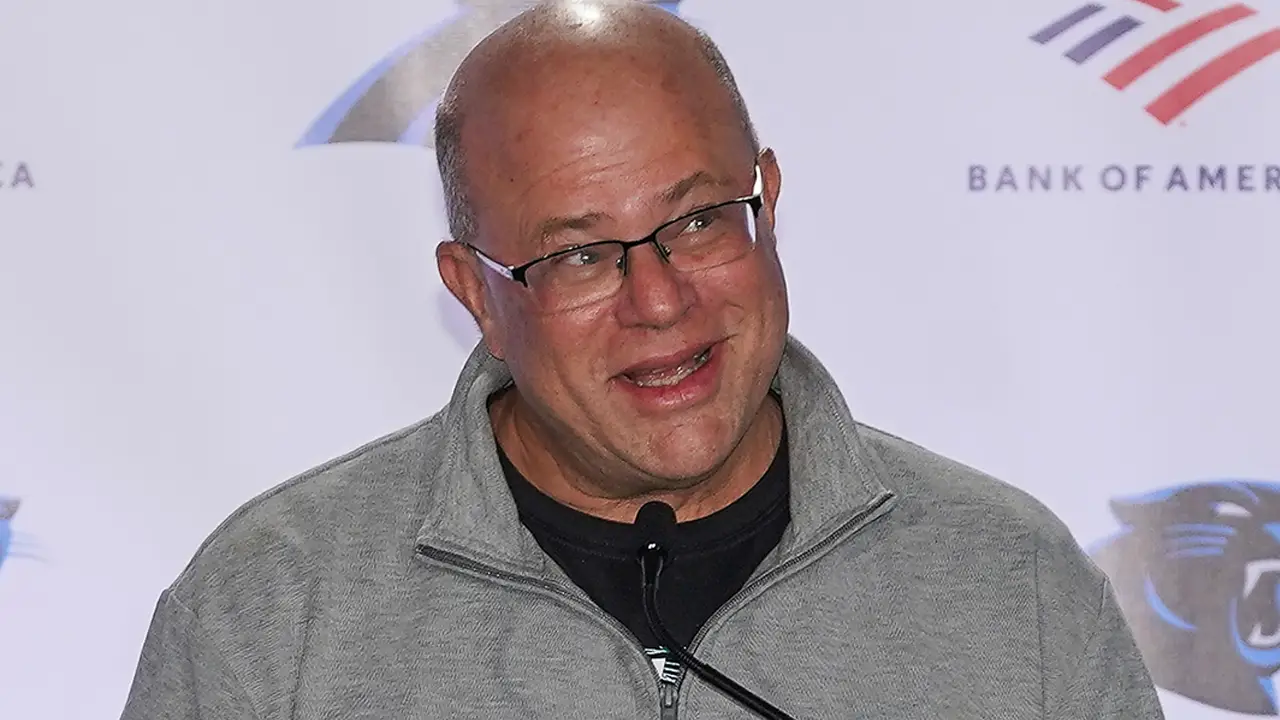

Investing can be like a game of chess, with every move impacting your overall strategy. David Tepper, the founder of Appaloosa Management and owner of the Carolina Panthers, is one such master player who has forged his path in this complex world. According to him, identifying potential investment opportunities requires keen observation skills and understanding market dynamics. He advises investors to look for stocks or sectors that have been undervalued by others.

Delving deeper into Tepper’s advice, we find three key components:

- Research: He believes thorough research is essential before any investment decision. This includes studying economic trends, understanding the company’s financial health and evaluating its future growth prospects.

- Risk assessment: An investor should not just focus on potential returns but also consider possible risks associated with an investment.

- Persistence: Lastly, Tepper emphasizes patience and persistence as crucial traits for successful investing. Opportunities might not always appear instantly; sometimes they emerge over time.

In conclusion, David Tepper’s advice encapsulates the essence of smart investing: Thorough research combined with risk evaluation and persistent effort.

The Importance of Due Diligence in Venture Capital According to David Tepper

David Tepper, a well-respected figure in the world of finance and investment, emphasizes that due diligence is an essential part of venture capital. As he sees it, this thorough review process helps investors make informed decisions about whether to support a new startup or not. His perspective is backed by years of success in managing investments and turning them into lucrative ventures.

Tepper stresses that performing due diligence involves more than just examining financial statements; it requires digging deep into every facet of a company’s operations. This includes understanding the business model and market potential, assessing the team’s ability to deliver on their vision, looking at competitive pressures, identifying legal or regulatory risks etcetera.

- Analyze Financials:Detailed exploration into revenue trends, cost structures and cash flows provides insight on stability and growth prospects.

- Evaluate Team Strength: A talented team with proven expertise can navigate through challenges ensuring company’s success.

- Mitigate Risks: Identifying any potential legal or regulatory problems upfront prevents future complications .

- Competitive Analysis:A thorough knowledge about competitors equips companies with strategies to outperform them.

In his view, skipping these steps could place your investment at risk as you’ll be investing blindly without understanding what you’re getting yourself into. Hence he affirms that conducting due diligence isn’t simply an option but indeed an absolute necessity for successful venture investing.

David Tepper on venture capital

David Tepper on venture capital

You may also like: What Masayoshi Son thinks about venture capital

David Tepper on Building a Diverse Portfolio in Venture Capital

David Tepper, with his immense knowledge and deep understanding of financial markets, is renowned for his expertise in Venture Capital investment. He has always advocated for the importance of establishing a diverse portfolio. According to him, diversification isn’t just about spreading your eggs into different baskets; it’s more about choosing the right baskets.

Tepper recommends focusing on sectors that show promising growth potential. For instance, consider these domains while building a diverse investment portfolio:

- Technology: The tech industry is constantly evolving with new startups disrupting traditional business paradigms every day.

- Clean energy: With climate change becoming an increasing concern, clean energy startups are gaining significant traction.

- E-commerce: Online shopping platforms have seen exponential growth over the past decade and exhibit huge future potential.

One of David Tepper’s golden rules is not to shy away from risky investments. In venture capital investing, sometimes you need to take calculated risks to reap substantial rewards.

Venture capitalists like Tepper understand that some ventures will inevitably fail but banking on a broad array of industries, can minimize risk and maximize overall returns. Including companies at various stages – from early-stage startups showing great promise to established firms undergoing expansion – aids in maintaining balance within your portfolio. It’s crucial not only because it allows exposure across multiple market segments but also because each stage comes with its own set of opportunities and challenges.

At the end of the day, building a diverse portfolio requires due diligence, experience-based judgment calls, and often riding out volatile market trends patiently. And if there’s one thing we’ve learned from David Tepper: diversity isn’t just prudent—it’s essential.

Conclusion: Key Takeaways from David Tepper’s Approach to Venture Capital Investing

David Tepper’s approach to venture capital investing is rich with insightful takeaways for both seasoned investors and newcomers alike. First off, Tepper emphasizes the importance of due diligence before any investment decision. He advocates for extensive research about a potential startup – its financial situation, business model, scalability prospects and leadership team. His method teaches us that placing bets on promising startups without a thorough understanding of their foundations could spell disaster.

Next, he stresses the need for diversification in venture capital portfolios. Just like you wouldn’t put all your eggs in one basket; investing across different industries provides some level of protection against market volatility or an unexpected downturn in one sector.

- Diversify investments: It minimizes risk by spreading investments across various sectors instead of concentrating them into just one.

- Risk management: This also plays into his practice of effective risk management where he ensures that no single loss can wipe out significant portions of his portfolio.

Tepper’s approach underscores the value associated with mispriced opportunities – those diamonds in the rough undervalued by other investors but have great potential to provide above-average returns if identified correctly.

At the end of it all, patience reigns supreme. The market may not always respond immediately to value-based decisions made today but Tepper reassures that staying loyal to sound investment principles will ultimately pay dividends down the line.

In essence, David Tepper’s philosophy combines savvy analysis with patient application proving there is indeed wisdom behind wealth creation via venture capitalism.

Read also: at which stage venture capital funds a startup