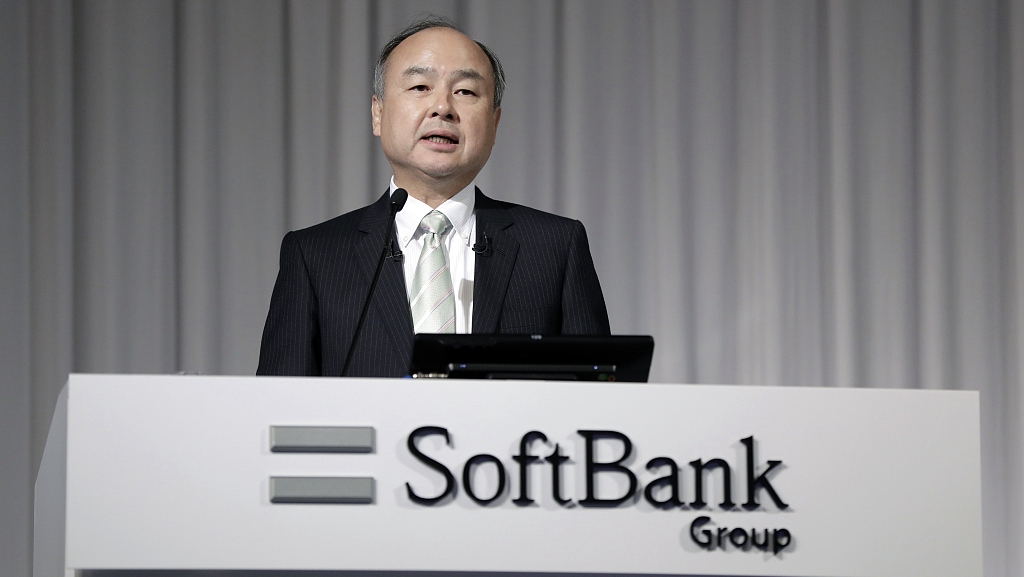

Curious about the thoughts and opinions of one of the biggest names in venture capital? Look no further! As a longtime member of this exciting industry, I’ve had the opportunity to witness firsthand what Masayoshi Son, founder and CEO of SoftBank Group Corp., truly thinks about venture capital. And let me tell you, it’s not all rainbows and unicorns. But don’t worry, I’ll give you a full rundown on his insights so you can better understand the ever-evolving world of venture capital. So buckle up and get ready for an insider perspective on what Masayoshi Son really thinks about venture capital!

So, What Masayoshi Son thinks about venture capital?

Masayoshi Son, the founder and CEO of SoftBank Group, has a unique perspective on venture capital. While many view venture capital as a risky investment strategy, Son sees it as an opportunity to support and nurture innovative ideas that have the potential to change the world.

Son believes that traditional venture capitalists focus too much on short-term returns and are not willing to take big risks. He instead takes a long-term approach, investing in companies that may not show immediate profits but have the potential for exponential growth in the future.

He also emphasizes the importance of building strong relationships with entrepreneurs and providing them with resources beyond just financial backing. This includes mentorship, connections to other successful entrepreneurs, and access to SoftBank’s vast network of companies.

Son’s vision for venture capital is one of collaboration rather than competition. He encourages his portfolio companies to work together and share knowledge and resources in order to achieve greater success.

In addition, Son is known for making bold investments in emerging technologies such as artificial intelligence, robotics, and renewable energy. He believes these industries will shape our future society and wants SoftBank to be at the forefront of their development.

Overall, Masayoshi Son sees venture capital as a means of supporting innovation and driving positive change in society. His unconventional approach challenges traditional views on risk-taking and highlights the importance of fostering strong partnerships between investors and entrepreneurs.

Understanding the Investment Philosophy of Masayoshi Son

Masayoshi Son, the enigmatic founder and CEO of SoftBank Group, has an investment philosophy that’s as distinctive as his personality. Known for making incredibly bold bets on future technologies, he maintains a unique approach to investing grounded in optimism and audacious vision. His philosophy isn’t built on quick returns or short-term gains but rather on betting big on technological breakthroughs that might seem risky at first glance but have the potential to revolutionize industries if they succeed.

Son’s strategy involves three key principles:

- Investing in visionary entrepreneurs: Son looks for individuals who possess game-changing ideas along with the drive and tenacity to make them a reality.

- Focusing on disruptive technologies: He is particularly drawn towards new technology sectors such as artificial intelligence, robotics, and the internet of things (IoT) which can upset traditional markets.

- Taking calculated risks: While some criticize his aggressive investments as reckless spending, Son views them as strategic plays backed by careful thought and analysis.

Throughout his career, Masayoshi Son has demonstrated an unwavering belief in future possibilities which forms the backbone of his investment strategy. Whether it’s backing then-unknown companies like Alibaba or daringly buying ARM Holdings amidst financial uncertainty – these decisions underline not just a willingness to take risks but also a conviction about where humanity is headed technologically.

Masayoshi Son’s Approach to Risk in Venture Capital

Masayoshi Son, the founder of SoftBank, has a maverick approach to risk in venture capital that sets him apart from others in his field. He is not afraid to take big risks and make massive investments, convinced that this is the best way to discover extraordinary companies with potential for exponential growth. A keen believer in future technology trends, he bets heavily on sectors like AI, robotics and IoT where he perceives disruptive potential.

Son’s methodology can be summarized as follows:

• Bet Big: One of the hallmarks of Son’s strategy is making huge investments. For instance, SoftBank invested $32 billion into UK chipmaker Arm Holdings in 2016.

• Innovation Factor: He places high importance on investing in groundbreaking technologies or business models that have the ability to redefine entire industries.

• Gut Instincts: Another aspect central to his approach involves trusting gut feelings over data-driven analysis more often than not.

In contrast to other venture capitalists who focus on stability and gradual growth, Son sees value where most see uncertainty. In spite of facing setbacks due to losses from some investment choices such as WeWork and Uber Technologies Inc., these instances haven’t deterred him. Instead they appear only to reinforce his conviction – no amount of risk seems too great when chasing revolutionary breakthroughs. His audacious stance might seem brash but it undeniably forms an intrinsic part of Masayoshi Son’s unique venture capital DNA.

Read also: What Mukesh Ambani thinks about joint ventures

The Role of Vision and Innovation in Masayoshi Son’s Perspective

The Role of Vision and Innovation in Masayoshi Son’s Perspective

Even as a young boy, Masayoshi Son had an insatiable appetite for innovation and a solid vision. His perspective towards life has always been influenced by his profound belief that possibilities are endless, if you dare to dream big. He nurtured this mindset from early on, constantly challenging the norms and daring to think differently to shape up his future endeavors.

Born into poverty stricken family in Japan, he didn’t let circumstances hamper his ambitions. Instead, he saw it as motivation to fuel his journey towards success.

Masayoshi Son believes strongly in leveraging technological innovations for societal development. He envisioned a world where technology would be used not just for materialistic gains but also for improving overall human well-being.

His investment strategy reflects this belief; focusing primarily on startups with innovative technology that can benefit society at large.

- SoftBank,

the multinational conglomerate founded by him is testament to such a philosophy.

It funds diverse tech companies worldwide including those involved with artificial intelligence (AI), robotics or Internet services; driving forward technologically advanced solutions which contribute positively towards our daily lives.

How Masayoshi Son Sees Growth Potential in Startups

Masayoshi Son has a unique, almost instinctive knack for identifying startups with immense growth potential. He doesn’t simply glance at numbers or delve into complex data analyses; instead, he looks beyond the conventional to explore the transformative power of technology in shaping our future. This inquisitive outlook allows him to identify those groundbreaking solutions and business models that are often overlooked by others.

Son’s approach comprises two key elements: a profound understanding of emerging markets, and a keen interest in innovative technologies. Let’s take an illustrative journey through his vision:

- Pioneering Spirit: Son is not afraid to venture where few dare. He seeks ideas that challenge norms and promises transformation. Even if there are hiccups along the way, like with Uber or WeWork, he believes their disruptive nature holds promise for unprecedented growth.

- Sector Agnostic: While many investors focus on specific sectors, Son’s playbook transcends industry boundaries. For instance, his investments span from e-commerce platforms like Alibaba to chip manufacturers like ARM Holdings.

- Innovation Embracer: His investment portfolio is teeming with companies focusing on AI (artificial intelligence), IoT (Internet of Things), robotics – all domains standing at the forefront of technological innovation.

In short, Masayoshi Son isn’t merely investing—he’s banking on bold visions reshaping our world.

What Masayoshi Son thinks about venture capital

What Masayoshi Son thinks about venture capital

You may also like: joint ventures in Electronics industry

Masayoshi Son’s Views on Long-Term vs Short-Term Investments

Masayoshi Son, the visionary founder and CEO of SoftBank Group, has pretty fascinating views when it comes to investment strategies. For him, investing isn’t just a game of numbers or a quick race to see who can build wealth the fastest. Rather, he believes in carefully selecting opportunities that may take time to bear fruit but promise significant long-term growth and value creation.

Son’s philosophy is steeped in patience. He doesn’t look for investments that will produce immediate returns; instead, he looks at what could be big ten years down the line. That’s why his eyes light up with excitement when talking about areas like artificial intelligence (AI), robotics, or clean energy technologies – fields expected to transform our world significantly over the next few decades.

- Artificial Intelligence: Son sees AI as an industry on verge of explosive growth.

- Robotics: With technological advancements happening every day in this sector, Son perceives enormous potential here.

- Clean Energy Technologies: As we shift towards more sustainable solutions globally, Son considers this field ripe for investment.

With these viewpoints encapsulating his whole approach towards investing: playing it slow but steady rather than rushing into things haphazardly for short gains. Because according to Masayoshi Son – if you’re only thinking short term then you might not be thinking big enough!

Conclusion: The Influence and Impact of Masayoshi Son’s Views on Venture Capital

Masayoshi Son, the founder and CEO of SoftBank, possesses a perspective on venture capital that has dramatically impacted not just his own organization but also the global start-up ecosystem. His distinct viewpoint emphasizes sizeable investments in young companies with great potential to innovate and transform industries – what he refers to as playing in the ‘World Cup’ of technology. This daring approach often results in significant risk-taking, including billion-dollar bets on unproven businesses, yet it’s these very risks that have paid off tremendously for many companies under Son’s wing.

Son’s philosophy relies heavily upon looking beyond short-term fluctuations or hiccups and focusing relentlessly on long-term growth potentials. This visionary mindset has redefined traditional venture capitalism by promoting audacious investment strategies over conservative ones. Key highlights include:

- Committing unprecedented amounts to WeWork, Uber, DoorDash amongst others.

- Funding emerging sectors like artificial intelligence (AI), robotics, ecommerce etc.

- Initiating Vision Funds which are unparalleled in scale within tech investing realm.

The influence and impact of Masayoshi Son’s stance towards venture capital is undeniable – from altering investment philosophies globally to driving technological advancements more aggressively than ever before.

Read also: joint venture business