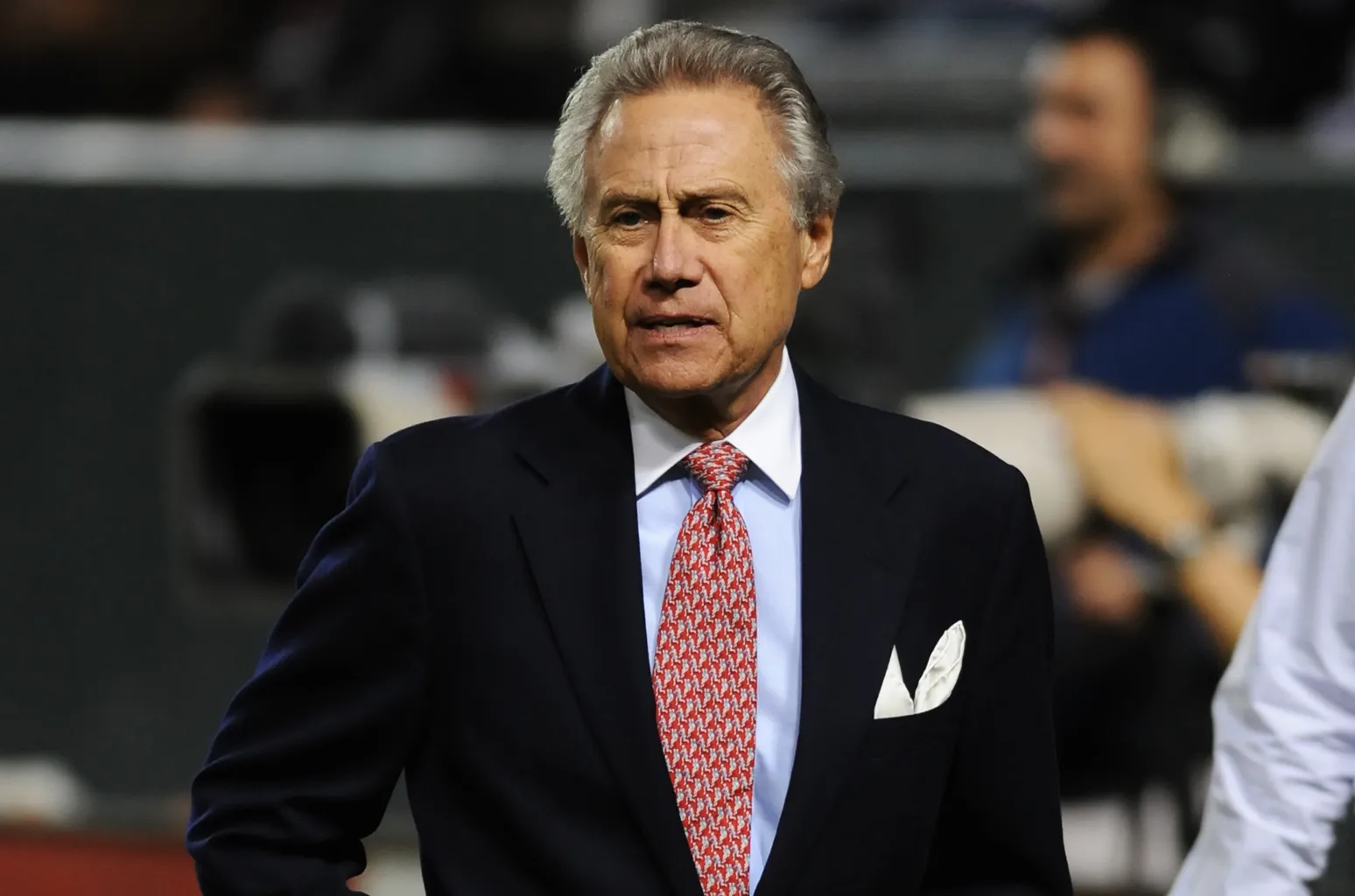

Curious about how a billionaire views venture capital? Wondering if there are any insights we can learn from one of the world’s wealthiest men, Philip Anschutz? Well, you’re in luck because I’ve done some digging and am excited to share what I’ve found! As an aspiring entrepreneur myself, I’m always interested in learning from those who have achieved massive success. And when it comes to venture capital, Philip Anschutz is definitely someone worth listening to.

In this article, we’ll delve into Anschutz’s thoughts on venture capital and gain valuable insight into his perspective on investing in startups. We’ll also explore his personal experiences with venture capital and how he has managed to make profitable investments in this field. So whether you’re a budding investor or just curious about what one of the richest people in the world thinks about venture capital, keep reading for some eye-opening revelations!

So, What Philip Anschutz thinks about venture capital?

Philip Anschutz, a billionaire businessman and investor, has a unique perspective on venture capital. While he acknowledges the importance of venture capital in fueling innovation and driving economic growth, he also believes that it is not the only path to success.

Anschutz understands that many entrepreneurs see venture capital as a necessary step in their journey towards building a successful company. However, he cautions against relying too heavily on this form of funding. He believes that too often, startups become overly focused on securing VC investments instead of focusing on creating sustainable business models.

Instead of solely seeking out venture capital, Anschutz encourages entrepreneurs to consider alternative sources of funding such as bootstrapping or angel investors. These options may require more patience and hard work, but they also allow for greater control over one’s business and can lead to long-term success.

Furthermore, Anschutz emphasizes the importance of having a solid business plan and clear goals before seeking any type of investment. He advises entrepreneurs to thoroughly research their market and potential customers before approaching investors. This approach not only increases the chances of securing funding but also sets businesses up for long-term success by ensuring they have a viable product or service with real demand.

In summary, while Philip Anschutz recognizes the benefits that venture capital can bring to startups, he urges entrepreneurs to think beyond this singular source of funding. By diversifying their options and prioritizing sound business strategies over quick injections of cash, aspiring business owners can increase their chances for lasting success in today’s fast-paced world.

Philip Anschutz’s Approach to Venture Capital

Philip Anschutz is a well-known American entrepreneur and businessman who made his fortune through a diverse range of investments. One of his most notable strategies in investing has been his approach to venture capital. Anschutz’s philosophy on venture capital centers around taking calculated risks, being hands-on with companies, and maintaining a long-term perspective.

Anschutz’s first key principle in venture capital is taking calculated risks. He believes that it’s important to assess potential opportunities carefully before making any investment decisions. This includes thoroughly researching the market, analyzing industry trends, and evaluating the company’s management team and business plan. By doing so, Anschutz minimizes his chances of investing in businesses that are not sustainable or profitable in the long run.

Furthermore, Anschutz takes a hands-on approach when it comes to managing his investments. Unlike some other venture capitalists who prefer to take a more passive role, Anschutz actively involves himself in the operations and decision-making processes of the companies he invests in. This allows him to have better control over how his funds are being used and also helps him build strong relationships with the management teams of these companies.

Lastly, one unique aspect of Philip Anschutz’s approach is his focus on long-term growth rather than short-term gains. Instead of looking for quick returns on investment, he prioritizes building successful businesses that will continue to thrive for years to come. This patient mentality has earned him great success as many of his ventures have become major players within their industries.

In conclusion, Philip Anschutz’s strategy towards venture capital combines careful risk-taking with active involvement and a long-term perspective. His success as an investor speaks volumes about this approach as it has allowed him to build an impressive portfolio

Analyzing Philip Anschutz’s Most Successful Venture Capital Investments

Philip Anschutz, a billionaire businessman, is renowned for his eye in spotting lucrative business opportunities. His venture capital investments have soared to great heights over the years, thanks to a few key successful ventures that stand out from the rest. Anyone seeking insight into smart investing strategies would do well to take a closer look at these examples.

The first on this list is Qwest Communications. In late 1980s, Anschutz bought a railroad company with distressed assets including some unused railroad lines; an investment which seemed puzzling at first glance but later proved remarkably prescient when he used those lines as groundwork for fiber optic networking cables. Qwest Communications was born and eventually became one of the leading telecommunication companies in North America.

Anschutz’s involvement with the sports & entertainment industry via AEG (the Anschutz Entertainment Group) also yielded impressive returns.

- AEG now owns or manages more than 120 world-class arenas, stadiums and clubs around the globe.

- The company made significant profit through LA Lakers tickets and concert events like Coachella festival.

- In addition to their sporting venues and major music festivals, they’re known for producing films such as The Chronicles of Narnia series under Walden Media – another Anschutz venture.

All these investments highlight Philip Anschutz’s uncanny ability not just in identifying high-potential industries but also utilizing existing resources creatively while expanding into new markets. It’s this balance of risk taking alongside careful planning that has cemented Mr.Anschutz’s place among top-tier venture capitalists globally.

Read also: What Jeff Yass thinks about venture capital

The Role of Risk Management in Philip Anschutz’s Venture Capital Strategy

The Role of Risk Management in Philip Anschutz’s Venture Capital Strategy

As a renowned business magnate, Philip Anschutz has honed his venture capital strategy over years, where risk management takes center stage. It’s like he dances with uncertainty but never lets it lead. He has developed an uncanny knack for identifying promising enterprises early on and investing judiciously while always bearing in mind the potential risks involved. His approach isn’t about avoiding risk entirely – that would be playing it too safe, which isn’t his style at all! Instead, he assesses each chance carefully to understand the possible pitfalls while still chasing high returns.

- He diligently scrutinizes every aspect: the company’s leadership structure,

- its financial strength,

- industry trends,

- competitor analysis etc.

After analyzing these factors thoroughly, he makes calculated decisions based on the balance between the anticipated return and associated risk.

His legendary investments in companies such as Union Pacific Railroad and Qwest Communications are testament to this unique blend of boldness and caution imbued in his venture capital strategy. But remember folks! This is not about reckless gambling – it’s careful strategizing. It’s taking leaps after measuring how deep or shallow waters are. Aspiring entrepreneurs can certainly learn a thing or two from Mr.Anschutz’s approach by understanding that successful ventures aren’t just about dreaming big; they’re also about managing risks smartly to turn those dreams into reality.

Understanding the Key Factors That Drive Philip Anschutz’s Investment Decisions

In a world buzzing with investment opportunities, the name Philip Anschutz stands out as a beacon of successful entrepreneurship. As one of America’s wealthiest individuals, understanding the elements that guide his financial decisions can teach us significant lessons about smart investing. His portfolio is diverse and spans from sports teams to movies, real estate to newspaper publishing. This vast array highlights one of Anschutz’s key principles: Diversification. He refuses to put all his eggs in one basket and seeks opportunities across various sectors, reducing risks associated with unpredictable market shifts.

Anschutz’s investment strategy also rests heavily on two more pillars: Innovation and Long-term view. With an eye always on future growth possibilities, he’s known for backing innovative ventures before they become mainstream successes – think Qwest Communications or Major League Soccer. But it’s not just innovation for its own sake; it was matched by a long-term perspective.

- Innovation: Philip believes in the power of creativity and forethought in business dealings. He spots trends early and invests ahead of time.

- The Long-Term View: Patience is another vital factor driving his investments—he holds onto assets until they mature into profitable entities.

Through these strategies—diversification, betting on innovation, maintaining patience for long-term profitability—Philip Anschutz has built an empire spanning multiple industries while keeping risk at bay. These are insightful gems one could consider when charting their own course towards successful investing.

What Philip Anschutz thinks about venture capital

What Philip Anschutz thinks about venture capital

You may also like: What companies are partnering with Microsoft?

How Philip Anschutz Balances Business Innovation and Financial Pragmatism in Venture Capital

Philip Anschutz, a name synonymous with success in the world of venture capital, possesses an uncanny ability to marry business innovation and financial pragmatism. His approach is akin to baking a cake; he masterfully blends calculated risk (the eggs) with groundbreaking ideas (the flour), and funds it all with seasoned experience (the sugar). Result? A prosperous venture that satisfies stakeholders’ appetite for growth and returns on investment. This billionaire businessman has built his empire by investing in diverse sectors such as sports, entertainment, real estate, newspapers, and even oil fields – where every project showcases this quintessential balance.

Anschutz’s recipe includes three main ingredients:

- Finding promising opportunities in growing sectors.

- Investing wisely without compromising innovation.

- Ensuring stability through strategic financial planning.

The AEG owner‘s skill set goes beyond merely spotting potential winners within emerging industries. It involves nurturing those prospects through deftly allocated resources while ensuring prudent fiscal decisions are made at each step of the company’s development journey. Whether it’s managing The Los Angeles Lakers or steering one of America’s largest theatre chains – Regal Cinemas – Philip Anschutz understands that both the sizzle of new ideas and the steak of smart money moves are required for long-term success.

Pitting business creativity against financial prudence can be like walking a tightrope; tilt too far either way, you risk falling off. But when an entrepreneur like Anschutz strides across that high wire balancing act – sparks fly! From beneath his feet springs forth entire industries invigorated by change while grounded in sound economic practices.

Conclusion: Summing Up What We Can Learn from Philip Anschutz’s Perspective on Venture Capital

The remarkable insight of Philip Anschutz into the world of venture capital is both enlightening and inspiring. A seasoned entrepreneur, Anschutz’s thoughtful approach to risk-taking and his unwavering belief in the potential for success have been instrumental in his astounding achievements. His perspective revolves around the importance of innovation, careful identification and evaluation of opportunities, calculated risks, and fostering collaborative relationships with promising entrepreneurs.

Anchored by a delicate balance between caution and ambition, he emphasizes that successful venture capitalists should not just be willing to take risks – they should also cherish them as catalysts for growth. The key here is not merely about taking on any opportunity that comes along but critically discerning which one holds substantial promise despite its inherent uncertainties.

What sets apart Anschutz’s approach even further is his firm conviction that investments are beyond mere monetary transactions. They encompass an integral commitment towards nurturing emerging businesses through strategic guidance and sustained support.

- Beyond dollars: He insists on investing time, effort, resources alongside finances.

- Mentorship: His perspective underscores how venture capitalists can act as mentors who shape budding entrepreneurs.

- Long-term vision: Short-sighted profit-mongering isn’t sustainable; instead focus on long-run value creation.

This holistic investment attitude fosters a thriving relationship with startups leading towards shared success.

In conclusion, Philip Anschutz’s perspective offers invaluable lessons for anyone interested in venturing into this high-stakes arena characterized by uncertainty yet profound potential. It teaches us about disciplined risk-taking balanced with prudent analysis while never losing sight of our role as cultivators nurturing young ideas into flourishing enterprises.

Read also: how small businesses can benefit from joint ventures