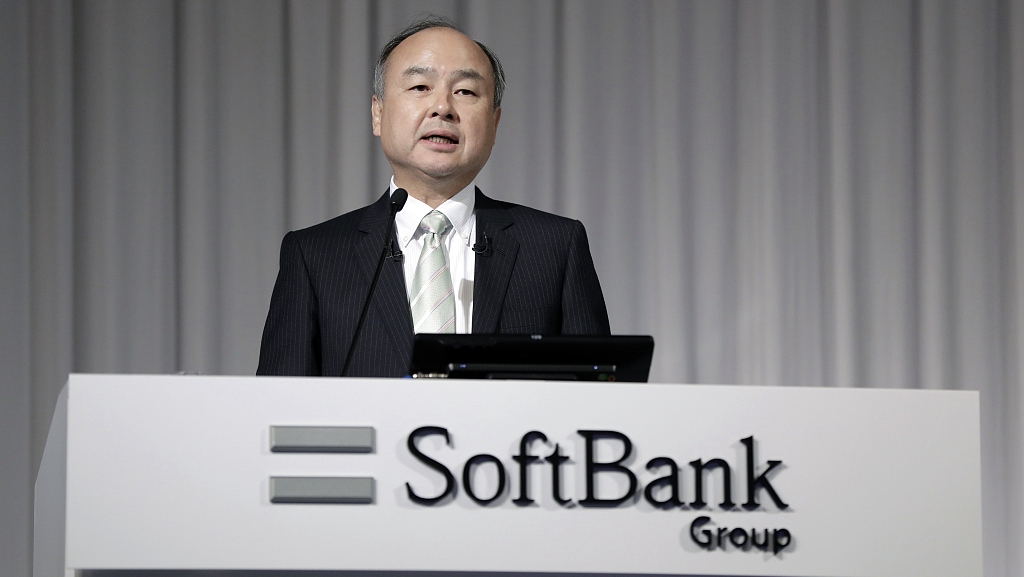

Are you curious about what Masayoshi Son, the founder and CEO of SoftBank Group Corp., has to say about joint ventures? As a seasoned entrepreneur who has been at the helm of one of the world’s largest investment firms for decades, he undoubtedly has valuable insights on this topic. And in this article, I’ll be sharing some insider information on what Son really thinks about joint ventures. From his personal experience to his expert opinions, we’ll dive into the mind of this influential business leader and uncover his thoughts on these strategic partnerships. So if you’re considering entering into a joint venture or simply want to learn more about them from an industry titan, keep reading!

So, What Masayoshi Son thinks about joint ventures?

Masayoshi Son, the CEO of SoftBank Group, has been known for his bold and ambitious business strategies. One of these strategies is forming joint ventures with other companies to expand their reach and capabilities.

So what does Masayoshi Son really think about joint ventures? According to insiders, he sees them as a way to accelerate growth and innovation. By partnering with another company, SoftBank can tap into their expertise and resources while also bringing in fresh ideas and perspectives.

Son believes that joint ventures allow both parties to benefit from each other’s strengths and fill in any gaps they may have. This collaborative approach allows for faster decision-making and execution, which is crucial in today’s fast-paced business world.

However, Son also understands the importance of choosing the right partner for a successful joint venture. He looks for companies that share similar values and visions, as well as those who are willing to take risks and think outside the box.

Overall, Masayoshi Son sees joint ventures as a valuable tool for driving growth and staying ahead in an ever-changing market. With his innovative mindset and strategic partnerships, it’s no surprise that SoftBank continues to be at the forefront of technology advancements.

The Role of Joint Ventures in SoftBank’s Growth Strategy

Joint ventures have become an integral part of SoftBank’s growth strategy in recent years. This multinational conglomerate, headquartered in Japan, has made a name for itself by investing in high-growth technology companies around the world. However, it is through joint ventures that SoftBank has been able to truly expand its reach and solidify its position as a major player in the global tech industry.

One of the key benefits of joint ventures for SoftBank is the opportunity to gain access to new markets and industries. By partnering with established companies or startups in different sectors, SoftBank can diversify its investment portfolio and tap into emerging trends. For example, their joint venture with Chinese e-commerce giant Alibaba allowed them to enter the booming market of online retail. Similarly, their partnership with Uber helped them enter the ride-hailing sector and capitalize on the growing demand for transportation services. These strategic collaborations not only bring financial benefits but also provide valuable insights and expertise from industry leaders.

Another advantage of joint ventures for SoftBank is risk reduction. By sharing resources and responsibilities with other companies, they are able to mitigate potential risks associated with new investments or projects. This allows SoftBank to take calculated risks without jeopardizing their entire business operations. Furthermore, joint ventures also offer cost-sharing opportunities which can help reduce financial burdens for both parties involved. With this approach, SoftBank can continue its rapid expansion while minimizing potential downsides.

In conclusion, joint ventures play a crucial role in driving Softbank’s growth strategy by opening up new avenues for investments and reducing risks associated with expansion efforts. Through these partnerships, they are able to stay ahead of competition and maintain their position as one of the most influential players in the tech industry.

Exploring Masayoshi Son’s Business Philosophy on Cooperation

During his dynamic career, billionaire businessman Masayoshi Son of SoftBank has proven that cooperation is vital in running a successful business. The visionary entrepreneur believes deeply in the power and impact of collaboration between people and enterprises. His philosophy emphasizes not only on generating profits but also fostering strong bonds among team members and partners – creating an environment where everyone works together towards shared goals. It’s this kind of camaraderie he believes, that drives advancements and helps overcome challenges.

Son’s cooperative approach extends beyond teamwork to include strategic alliances with other companies as well. This emphasis on partnerships can be seen across his diverse portfolio from tech startups to established global corporations like Sprint or Alibaba.

- Sprint: When SoftBank took over Sprint, it wasn’t just about investing money into a struggling company; it was about bringing together two different cultures for joint success.

- Alibaba: One of Masayoshi’s most profitable investments was in Alibaba – marking an incredible example of international collaboration with Chinese entrepreneur Jack Ma.

In conclusion, Masayoshi Son’s ethos is all about achieving greatness through unity. Underpinning all his business decisions is the enduring belief that cooperating – whether internally within teams or externally via partnerships- produces superior outcomes than going at it alone.

Read also: What is an example of United airline partnership?

Understanding the Benefits and Risks of Joint Ventures: Insights from Masayoshi Son

Masayoshi Son, the charismatic CEO of SoftBank Group, has a wealth of experience in joint ventures. His bold and ambitious strategies provide valuable lessons for business enthusiasts and entrepreneurs alike. From building partnerships with giants like Yahoo to launching the Vision Fund – the largest tech-focused venture capital fund in history – Son’s approach to joint ventures is both enlightening and inspiring.

Son perceives joint ventures as crucial conduits for innovation, collaboration and growth; they demonstrate potentials that would be challenging to realize independently. Through his endeavors, he illustrates how embracing these collaborations can propel businesses into new markets, diversify their portfolio or fuel technological advancements.

However, Son’s journey also underscores potential risks associated with joint ventures. With high stakes come high risks – it’s an inevitable part of any significant business undertaking. In particular, differences in corporate culture or goals can lead to clashes that destabilize partnerships; something which was evident during SoftBank’s partnership with WeWork where divergent visions resulted in turbulence.

- Rapid expansion: Joint ventures offer opportunities for rapid expansion into new markets without needing extensive local knowledge or resources.

- Diversification: Collaborating with other companies allows businesses to diversify their portfolio reducing risk exposure while maximizing returns.

- Innovation boost: The fusion of different competencies encourages innovation leading to cutting-edge solutions.

- Culture clash: Differences between company cultures could cause conflicts disrupting operations.

- Vision divergence:Mismatched goals may obstruct progress potentially risking investment losses.

But these benefits are not without:

Therefore, understanding this duality is essential when considering such strategic alliances.

Masayoshi Son’s Approach to Selecting Partners for Joint Venture Initiatives

Masayoshi Son, the founder of SoftBank Group Corp, has a unique approach when it comes to selecting partners for joint venture initiatives. His emphasis is not just on the financial feasibility of potential partners, but also their dedication towards achieving innovative technological outcomes. For him, choosing a partner goes beyond monetary considerations; what truly matters is their shared vision and commitment to pushing boundaries in technology.

Son seeks out companies that are ready to disrupt traditional industries with groundbreaking ideas. He admires those who dare to dream big and have the grit required to turn these dreams into reality. Here’s what he looks for:

- Ambitious Vision: Partners should share Son’s belief in Information Revolution – Happiness for everyone.

- Innovation: He particularly appreciates businesses that are willing and eager to disrupt established norms through innovation.

- Dedicated Teams: Finding committed teams who passionately work towards turning ambitious visions into reality is key.

Son’s approach relies on long-term relationships, which means there must be mutual respect between all parties. His selection process can seem unconventional compared with traditional business methods, but this strategy has led SoftBank Group Corp to become one of the world’s largest tech-focused private equity funds.

What Masayoshi Son thinks about joint ventures

What Masayoshi Son thinks about joint ventures

You may also like: Significant Business Partners of Meta Platforms, Inc.

How Masayoshi Son Maneuvers Through Challenges in Joint Ventures

Masayoshi Son, the charismatic founder and CEO of SoftBank, has an uncanny ability to turn challenges into opportunities, particularly when it comes to joint ventures. One could argue that his strategy is a masterful blend of vision-driven tenacity and pragmatism. When faced with potential roadblocks, Son’s approach isn’t one of avoidance or fear but rather determination and resilience.

An essential aspect of this strategy is his willingness to make bold decisions based on his long-term vision. This can be seen in the way he navigates joint ventures—whether that means investing heavily in technology startups or extricating SoftBank from partnerships that no longer align with its goals.

For instance, during the WeWork debacle, many viewed Softbank’s significant investment as a colossal mistake. Yet Son managed to navigate through these choppy waters by restructuring WeWork’s management team and spearheading its operational overhaul – demonstrating how resilient he can be amidst turbulent times.

Rather than withdrawing at the first sign of trouble, Masayoshi takes charge directly – even if it requires making tough choices:

- Negotiating for better terms,

- Pump more funds into underperforming investments,

- Or even buying out partners when necessary.

His courage in tackling adversity head-on combined with his strategic foresight makes him standout among business leaders globally. It’s not just about staying above water during rough patches; it’s about guiding the ship forward towards brighter horizons despite stormy seas.

Conclusion: Reflecting on What We’ve Learned about Masayoshi Son’s Perspective on Joint Ventures

As we draw our exploration to a close, it’s striking to stand back and behold the unique perspective that Masayoshi Son holds regarding joint ventures. His approach isn’t just about business expansion or financial gain; it’s centered around building mutual relationships, fostering innovation, and cultivating long-term growth. This is all accomplished through collaboration which he believes in strongly. The ability for companies to learn from each other, share resources and combine their strengths optimally illustrates his vision on such partnerships.

This profound understanding of unity in diversity has been a guiding force in many successful alliances steered by him throughout his career. Masayoshi Son emphasizes the power of synergy, wherein different entities come together for shared objectives leading to results greater than what they could have achieved independently.

- He underscores the importance of honesty.

- He champions open communication.

- Last but not least, he advocates for shared values between partners as an essential foundation.

In reflection upon this wisdom offered by Masayoshi Son surrounding joint ventures is like opening up a treasure chest filled with priceless pearls of knowledge that can help navigate any entrepreneur towards success.

Read also: how to value your startup for venture capital