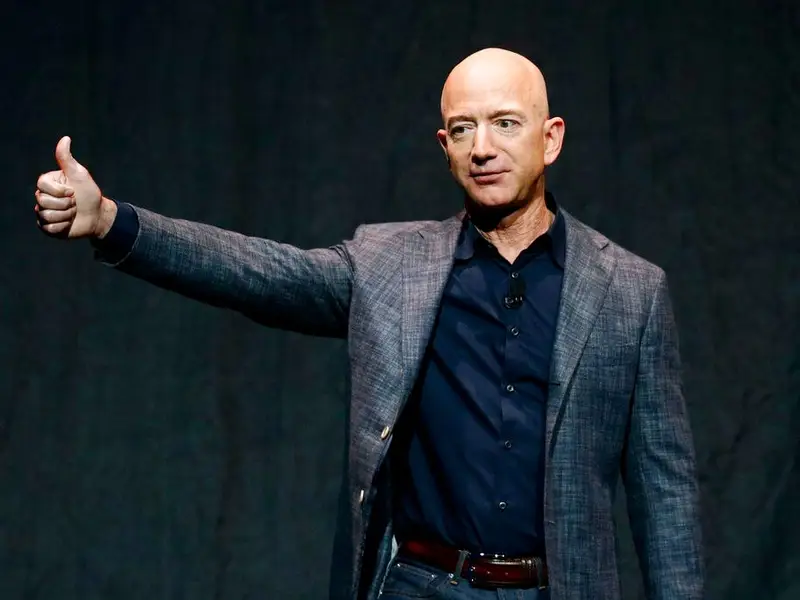

Do you want to know what goes on inside the mind of one of the world’s most successful entrepreneurs, Jeff Bezos? Especially when it comes to venture capital? Look no further! As someone who has been studying and researching this topic for years, I’ve gathered exclusive insider insights to share with you. From his thoughts on risk-taking and investments, to how he evaluates opportunities in the fast-paced world of venture capital, we’ll delve into it all. Get ready for a deep dive into the mind of Jeff Bezos and gain valuable knowledge that could help shape your own VC journey. So buckle up and let’s see what this billionaire visionary has to say about venture capital!

So, What Jeff Bezos thinks about venture capital?

As the founder and CEO of Amazon, Jeff Bezos is no stranger to venture capital. In fact, he has been on both sides of the table – as an entrepreneur seeking funding for his startup and as a successful investor in various companies through his personal investment firm, Bezos Expeditions.

So what does Bezos think about venture capital? According to him, it’s all about taking risks and being willing to fail. In an interview with Business Insider, he shared that “the biggest thing I’ve learned is that if you’re not failing enough, you’re not trying hard enough.” This mindset aligns with the high-risk nature of venture capital where investors are looking for potential unicorns but also understand that many startups will fail.

Bezos also emphasizes the importance of having a long-term vision when it comes to investing in startups. He believes that great businesses take time to build and grow and urges investors to be patient and give their portfolio companies time to succeed.

In addition, Bezos values innovation above everything else when evaluating potential investments. He looks for unique ideas or disruptive technologies that have the potential to change industries or create new ones altogether.

Overall, Jeff Bezos sees venture capital as a vital part of driving innovation and growth in the business world. And with his own success story as proof of its power, it’s safe to say that his insights on this topic are definitely worth paying attention to.

Jeff Bezos’s Perspective on the Role of Venture Capital in Business Growth

Jeff Bezos, the founder of Amazon and a self-made billionaire, has a unique perspective on how venture capital plays an instrumental role in business growth. In his view, it’s not just about getting funds; rather it’s about fostering innovation. This is why he launched Bezos Expeditions, his own venture capital firm that invests in startups with potential to bring groundbreaking ideas to reality.

In the world according to Bezos, venture capital represents more than just money—it’s also a vote of confidence that can empower entrepreneurs. Through investing, entrepreneurs are encouragedto think big, take risks and disrupt industries. He believes that when an entrepreneur receives an investment from a VC firm, they’re not only receiving financial support but also gaining valuable insights and advice from seasoned industry experts who’ve ‘been there’ before.

- The companies under Bezos Expeditions have flourished due to this approach.

- Ranging from Airbnb to Uber – these businesses have changed their respective industries dramatically,

- Fully exemplifying Jeff’s belief in the transformative power of strategic funding.

These philosophies highlighthow vital Bezos sees venture capital, viewing it as much more than mere financial aid; it’s also about guiding startups towards growth through mentorship and strategic insights. Truly emphasizingthe fundamental link between venture capital and business expansion.

Understanding Jeff Bezos’s Criteria for Worthwhile Investments

Understanding Jeff Bezos’s Criteria for Worthwhile Investments:

Jeff Bezos, the founder of Amazon and one of the most successful entrepreneurs in history, has a specific set of criteria he uses when deciding where to invest his money. This billionaire businessman looks beyond simple profitability; instead focusing on long-term potential, innovation, and customer-centric businesses. The first filter through which Bezos screens prospective investments is sustainability over the long haul. He is not interested in quick wins or short-lived trends. Instead, he seeks out companies that show promise for growth and scalability years into the future.

- Sustainability: For an investment to pique his interest, it must have what it takes to withstand market fluctuations while keeping its momentum.

- Innovation:The entrepreneur values businesses that are not just content with maintaining the status quo but rather constantly innovate to break new grounds.

- Customer-Centricity:Bezos believes that companies who prioritize their customers above all else will always be ahead of their competition.

Let us delve deeper into these criteria.

The sustainability factor ties back to Amazon’s own journey. Launched as an online bookstore in 1994, Amazon evolved into a global retail giant by continually adapting its business model to fit market demands. Meanwhile,innovation, another key criterion for Bezos’s investments goes hand-in-hand with this adaptability principle – after all, you can’t evolve without innovating! Lastly,customer-centricity. Ever since its inception (and captured perfectly in its motto ‘Customer Obsession’), Amazon has made every decision with customer satisfaction front-of-mind—a philosophy deeply ingrained from top down including its fearless leader—Mr.Bezos himself.

By identifying these core principles at work in potential investments, Bezos ensures he backs ventures poised for enduring success rather than fleeting triumphs. His investment philosophy offers a valuable lesson to both budding and seasoned investors alike—profitability is just one piece of the puzzle; long-term sustainability, constant innovation and an unwavering focus on customer satisfaction are equally vital ingredients in the recipe for true business success.

Read also: What Bill Gates thinks about venture capital

Risk-Taking and Innovation: Jeff Bezos’s View on Venture Capital Funding

Jeff Bezos, the visionary founder of Amazon, has a unique perspective when it comes to risk-taking and innovation in venture capital funding. In Bezos’s view, daring ideas often require significant financial backing; he believes that taking calculated risks is not only necessary for business growth but also serves as the lifeblood of innovation. While this philosophy may seem radical to some, it underpins his successful approach at Amazon – an empire built on ‘big bets’ or ambitious projects which have redefined online shopping.

Venture capital funding plays a pivotal role in this model, providing the fuel to drive these high-risk ventures forward. As per Bezos’s insights:

- Innovation requires investment: Not every idea will bear fruit instantly; some need time and money before their true value emerges.

- Risk is part of the package: No great achievement was ever made without navigating choppy waters. Tackling challenges head-on with resilience can lead to unprecedented outcomes.

- A culture of experimentation: It fosters creativity and helps businesses stay ahead in fast-paced markets like today’s tech industry.

For Jeff Bezos, venture capital funding isn’t just about securing resources for current operations—it’s about boldly striving toward audacious goals that reshape business landscapes and redefine what’s possible.

The Influence of Amazon’s Success Story on Jeff Bezos’s Approach to Venture Capital

When we discuss the impact of Amazon’s success story on Jeff Bezos and his approach to venture capital, it’s essential to recognize Amazon as more than just a revolutionary online marketplace. The company has also been a springboard for Bezos’ investment philosophy. As observed in companies such as Zappos and Whole Foods, which have significantly flourished under Amazon’s umbrella, this business mogul seeks out innovative businesses that share Amazon’s dedication to customer-centricity.

Bezos takes lessons from his journey with Amazon and applies them in selecting promising startups to support financially. He doesn’t merely invest; he collaborates, using his experience at the helm of Amazon to guide these fledgling entities towards success.

- Blue Origin, one of Bezos’ highest-profile investments focusing on space tourism, reflects an appetite for audacious ideas that challenge norms.

- Airbnb, another significant investment for him exhibits the same disruptive spirit that made Amazon great – changing traditional business models by leveraging technology.

- Both Zocdoc and Oscar Health, two health-related ventures backed by Bezos show how he values diversity in sectors while being keenly aware of user-focused solutions.

The influence of building a customer-obsessed empire like Amazon continues shaping Jeff Bezo’s venture capital endeavors – turning ambitious visions into game-changing realities.

What Jeff Bezos thinks about venture capital

What Jeff Bezos thinks about venture capital

You may also like: joint ventures in Electronics manufacturing industry

How Jeff Bezos Envisions the Future of Venture Capital Industry

As the founder of Amazon, Jeff Bezos has certainly made his mark on the world. Now, he’s turning that influential gaze to a new frontier: the venture capital industry. He believes in fostering an environment where both innovative ideas and valuable resources can collide to create something truly groundbreaking. Bezos envisions a future where investors are no longer bound by geographic constraints and can fund promising startups from any corner of the globe.

In this reinvented world of venture capitalism as seen through Bezos’ perspective, several key changes stand out:

- The power shift towards entrepreneurs.This is perhaps the most fundamental paradigm shift. According to Bezos, it’s high time for business magnates to start investing in genuine talent rather than just following market trends or sticking with familiar sectors.

- Increased focus on long-term investment strategies. Rather than seeking quick turnaround profits which often lead short sightedness in decision making at startups level , Bezos encourages investors to adopt patient capital approach focusing more on long term profitability and growth.

- A more diverse portfolio. The tech mogul also advocates for venture capitalists to step outside their comfort zones when selecting industries they invest into – essentially encouraging diversity within investment portfolios that will ultimately result into overall ecosystem enrichment .

This proposed future paints a picture of heightened opportunity, innovation, and economic expansion while challenging traditional norms within Venture Capital Industry. For budding entrepreneurs around the world still waiting for their big break – imagining such empowering vision coming true is indeed inspiring!

Conclusion: Key Takeaways from Jeff Bezos’s Thoughts on Venture Capital

Jeff Bezos, the mastermind behind Amazon’s phenomenal success has much to share about venture capital. One of his key takeaways is the importance of long-term thinking. Investment isn’t just about immediate gains; it’s a marathon, not a sprint. By keeping the focus on creating something sustainable and truly innovative, Bezos underlines that profits will inevitably follow. He also highlights that venture capitalists should be willing to take calculated risks for potentially high returns.

An equally important perspective from Bezos is embracing failure as an integral part of innovation. This viewpoint suggests that mistakes shouldn’t deter investors – instead they’re valuable learning opportunities in disguise. Furthermore, he emphasizes:

- The necessity of customer obsession: Successful ventures always keep customers at their core.

- The power of invention: Constant reinvention keeps businesses relevant and ahead in the game.

- <Fulfilling operational excellence: Efficiency aids in minimizing costs and optimizing outcomes.

In essence,

“To innovate you have to experiment, and if you know in advance it’s going to work, then it’s not an experiment.”– Jeff Bezos’ philosophy mirrors these words perfectly when studying his thoughts on Venture Capital.

Read also: what is joint venture in international business