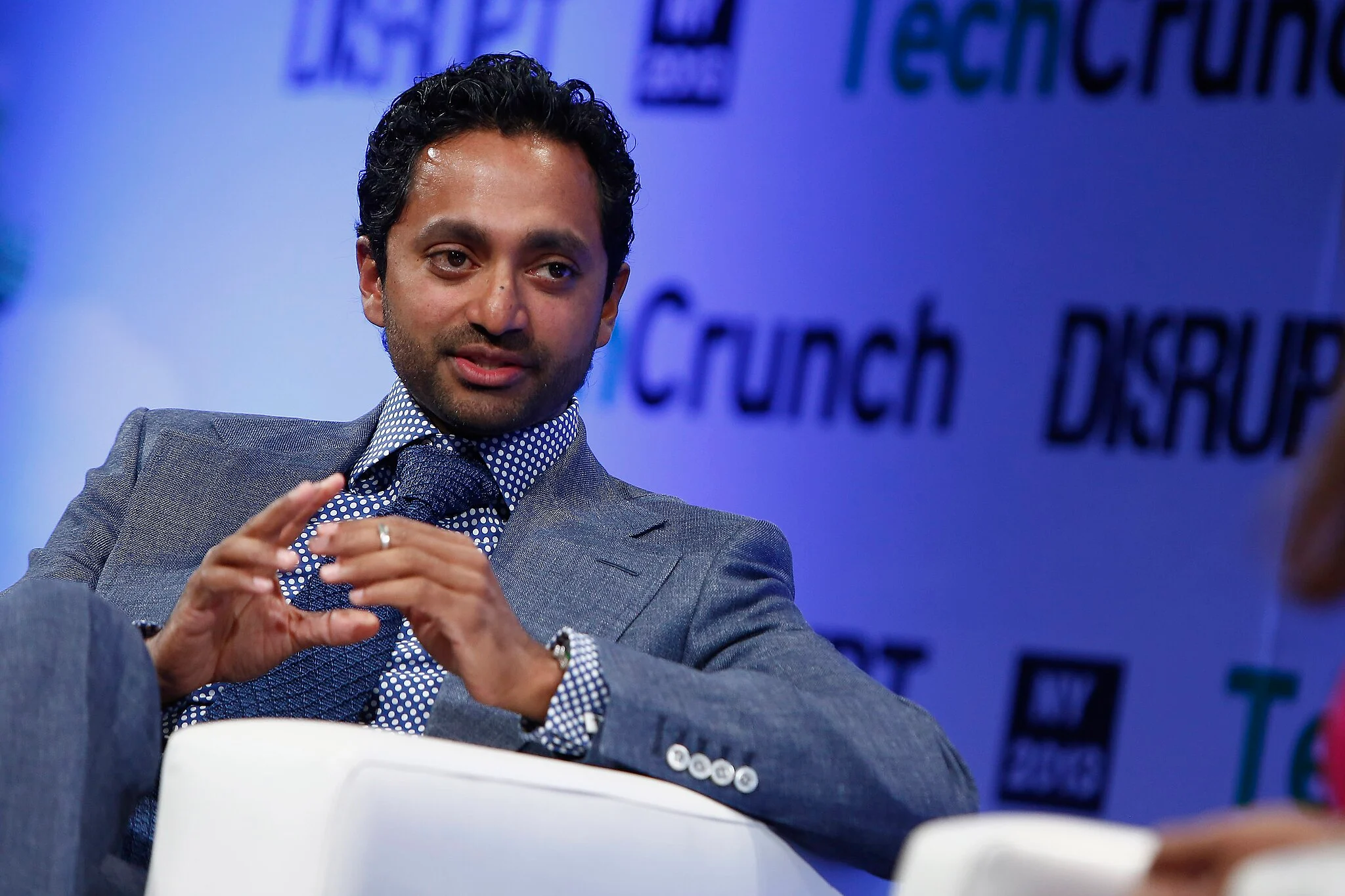

Have you ever wanted to know what goes on in the mind of a successful venture capitalist? Look no further! In this article, I’ll be taking a deep dive into the thoughts and insights of Chamath Palihapitiya, one of Silicon Valley’s most prominent and successful investors. As someone who has made his fortune through investing in some of today’s biggest companies, including Facebook and Slack, Chamath is definitely someone worth listening to when it comes to understanding the world of venture capital.

From his perspective on early-stage startups to his views on diversity and impact investing, we’ll cover everything you need to know about what Chamath Palihapitiya thinks about venture capital. By the end of this article, not only will you have gained valuable knowledge from a seasoned investor, but you’ll also have a better understanding of how venture capital works and how it can benefit both entrepreneurs and investors alike. So let’s get started and discover the inner workings of one of Silicon Valley’s top minds!

So, What Chamath Palihapitiya thinks about venture capital?

Chamath Palihapitiya is a highly successful venture capitalist and entrepreneur who has made a name for himself in the tech industry. He is known for his bold and unconventional approach to investing, often going against traditional norms and taking risks that have paid off tremendously.

When it comes to venture capital, Palihapitiya believes in investing in people rather than just ideas. He looks for passionate and driven entrepreneurs with unique perspectives and the ability to execute their vision. In an interview, he stated, “I think what makes great companies are really fantastic founders who have this incredible drive.”

Palihapitiya also emphasizes the importance of being patient when it comes to investments. Rather than focusing on short-term gains, he takes a long-term view and invests in companies that have the potential to disrupt industries and create lasting impact.

In addition, he believes in diversifying his portfolio across different sectors instead of putting all his eggs in one basket. This allows him to minimize risk while still having exposure to potentially high-growth opportunities.

Overall, Chamath Palihapitiya’s mindset as a venture capitalist revolves around finding exceptional individuals with big ideas and supporting them through strategic investments. His success speaks volumes about his approach, making him a highly sought-after investor by both entrepreneurs and fellow investors alike.

Chamath Palihapitiya’s Approach to Early-Stage Startups

Chamath Palihapitiya, a venture capitalist heavyweight and former Facebook executive, has an approach to early-stage startups that is both intriguing and inspiring. His method emphasizes the importance of well-designed products while highlighting the value of customer satisfaction. Chamath believes in investing time and resources into developing ingenious tech solutions that meet customer needs efficiently – he is not just about flashy ideas or lofty promises but rather on delivering practical solution.

However, Chamath’s unique approach doesn’t stop at product design; his focus extends to team building as well. He asserts the importance of gathering a group of dedicated individuals who are passionate about their work and committed to bringing innovative ideas to fruition. Believing in long-term growth, he urges startups not to blindly chase after quick revenue generation but patiently build solid foundations for sustainability.

- A diverse team with varying perspectives can be instrumental in creating original products.

- An environment fostering open communication encourages employees’ creativity.

In essence, Chamath Palihapitiya’s strategy encapsulates a balance between product innovation and strong team ethos combined with patient capital deployment – all aimed towards creating enduring businesses that provide value for customers over time.

How Chamath Palihapitiya Evaluates Potential Investment Opportunities

Chamath Palihapitiya, a prominent venture capitalist, is well known for his straightforward yet strategic approach to evaluating potential investment opportunities. He doesn’t merely rely on surface-level factors; rather, he delves deep into the fundamentals of the business. One of his primary focus points is understanding the problem that a specific company’s product or service aims to solve. If it’s a genuine issue with mass appeal and an effective solution in place, then it piques his interest.

His evaluation process further includes:

- Growth potential: Chamath firmly believes in betting on companies poised for substantial growth over time.

- Mission-driven leadership: The leader’s vision plays a significant role in determining whether or not he invests.

- Sustainability: Companies must prove they can cope with changing market dynamics and maintain long-term viability.

In addition to scrutinizing these fundamental aspects, Palihapitiya‘s approach extends beyond standard financial analysis. He adopts what might be considered as an empathetic lens towards decision-making by considering societal impact as part of his investing philosophy. For him, for example, it’s not just about how much profit a company generates but also about its broader contribution towards making society better – ultimately reflecting an investor mentality that combines sharp business acumen with social consciousness.

Read also: What Marc Andreessen thinks about joint ventures

Chamath Palihapitiya’s Views on Diversity in Venture Capital

Chamath Palihapitiya, a titan in the venture capital industry and former executive at Facebook, has long been an advocate for diversity within the financial realm. He ardently believes that representation is crucial to innovation and prosperity. Knowing that diverse perspectives breed transformative ideas, Palihapitiya champions these messages not just through his words but also actions. As the founder of Social Capital, he’s made it a mandate to invest in companies led by individuals from all walks of life, striving to break down barriers encountered by underrepresented entrepreneurs.

Furthermore, Chamath emphasizes that including diverse voices in decision-making processes isn’t merely about checking off boxes or fulfilling quotas. For him, it’s about fostering inclusive environments where everyone feels welcomed and empowered.

- He often notes how homogeneous teams tend to stumble into groupthink traps leading to stagnancy.

- Pursuing diversity challenges this pattern as people bring their unique experiences and insights into play.

This Silicon Valley investor passionately argues for venture capital firms’ responsibility towards actively seeking out varied ethnicities, genders, backgrounds—believing this will create more robust ventures while setting equitable standards across industries.

The Importance of Impact Investing According to Chamath Palihapitiya

Chamath Palihapitiya, an influential venture capitalist, ardently believes in the significance of impact investing. This conviction arises from a simple yet profound understanding – making money and changing the world are not mutually exclusive pursuits. Impact investing is about consciously putting your funds into businesses that aim to make a positive social or environmental difference while also generating financial returns. Through this method, investors have the dual satisfaction of seeing their wallet grow while contributing to societal change.

According to Palihapitiya, these are several reasons why impact investing is essential:

- Economic Sustainability: Businesses focusing on sustainability tend to be more resilient during economic downturns. Emphasizing long-term goals over quick profits leads to stronger business models built for endurance.

- Social Change: By supporting companies committed to solving global issues like poverty or climate change, investors can actively participate in creating a better world.

- Potential High Returns: Contrary to popular belief, socially and environmentally conscious firms often outperform traditional investments due to increasing public awareness about these issues leading to higher demand.

With his firm Social Capital, Chamath has demonstrated how impactful investments can create value both financially and socially by backing ventures focused on healthcare reform or education equality. His success serves as testament convincing others of the vast potential inherent within this investment approach.

What Chamath Palihapitiya thinks about venture capital

What Chamath Palihapitiya thinks about venture capital

You may also like: joint ventures in Soft drinks manufacturing industry

What Sets Chamath Palihapitiya Apart in the World of Venture Capital

It’s not just about the fact that Chamath Palihapitiya is a hugely successful venture capitalist, but also his approach to investing and his keen instinct for technological trends that sets him apart in this competitive field. Palihapitiya, a former Facebook executive, founded Social Capital in 2011 with an original and groundbreaking mission: to solve the world’s highest value problems through technology. His investments are often characterized by bold bets on innovative companies that have the potential to disrupt industries or create brand new ones – from healthcare technologies to financial services.

Palihapitiya’s unique approach extends beyond simply backing promising tech start-ups. He is known for his belief in ‘unlearning’ traditional investment strategies – challenging old norms and bringing fresh perspectives into play. This distinctive way of thinking has led him into some truly transformative business ventures.

- Tesla, where he recognized Elon Musk’s vision way before many others,

- Bitcoin, where he saw its potential as a hedge against traditional banking structures long before it became mainstream,

- Social media platforms like Slack and Yammer, where he anticipated their role in transforming corporate communication.

In many ways, Chamath Palifhapitiya represents the next generation of venture capitalists; unafraid of taking risks, embracing innovation, and most importantly trying out non-conventional methods while keeping ethics at its core. There may be other players who make similar moves but it is Chamath’s conviction combined with smart strategy that truly sets him apart from them all.

Conclusion: Lessons from Chamath Palihapitiya’s Philosophy on Venture Capital

For anyone interested in the world of venture capital, Chamath Palihapitiya’s philosophy is a goldmine of insights and wisdom. His unique perspective on investing not only challenges traditional norms but also places immense value on long-term visions over short-term gains. One vital lesson from his philosophy revolves around patience. Palihapitiya advises potential investors to resist the urge for instant gratification and focus instead on companies with sustainable models that promise growth in the future.

In contrast to many other venture capitalists who invest based solely on trends or hype, Palihapitiya urges investors to delve deeply into understanding a company’s fundamentals. This involves looking at their business model, market potential, competitive advantage and management team among others before making an investment decision.

- Resilience: He emphasizes resilience as key amongst start-ups because the journey is filled with uncertainties.

- Innovation: Innovation should be at the core of any start-up worth investing in according to him.

Palihapitiya’s approach encourages investors not just to ‘throw money’ at ventures but rather engage meaningfully – fostering dialogue, providing guidance where necessary and sticking it out through thick and thin. At its heart lies an unwavering belief in human ingenuity – which he believes will always trump current circumstances. This bold vote-of-confidence often acts as much more than mere financial support – it serves as startup fuel that can ignite success even amidst adversity.

Read also: joint venture in international business