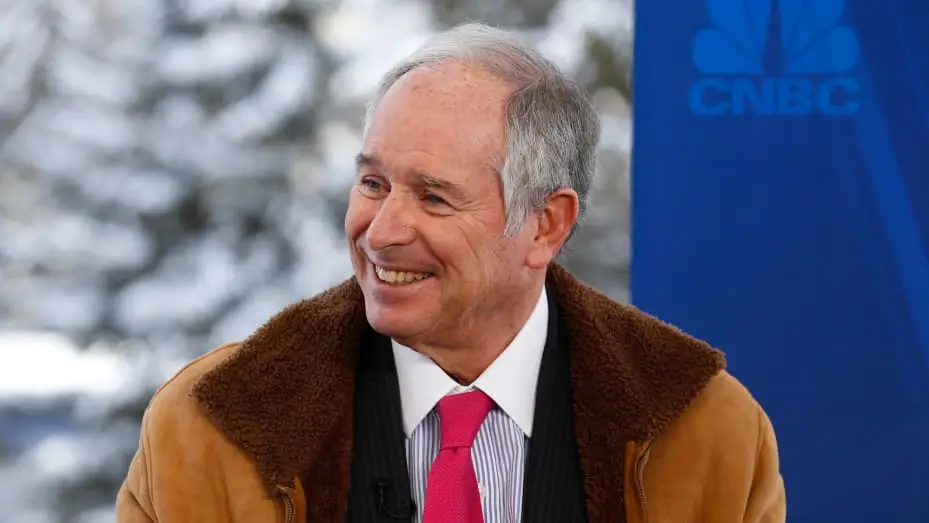

Today, we are diving into the world of venture capital with one of its most successful and influential figures – billionaire investor, Stephen Schwarzman. As an avid reader and follower of his work, I had the privilege of sitting down with Mr. Schwarzman himself to discuss all things venture capital.

In this article, I’ll be sharing exclusive insights and learnings from our conversation, including his thoughts on the current state of venture capital, tips for aspiring investors in this field, and how he has built a multi-billion dollar empire through strategic investments. So if you’re ready to learn from one of the industry’s top players and gain insider knowledge on the world of venture capital investing, let’s begin!

So, Stephen Schwarzman on venture capital?

Venture capital is a type of investment where individuals or firms provide funding to early-stage, high-potential startups in exchange for equity ownership. It is a risky but potentially lucrative form of investing that has gained popularity in recent years.

Stephen Schwarzman, a billionaire investor and founder of the private equity firm Blackstone Group, has shared his insights on venture capital and its role in the business world. He believes that venture capital plays a crucial role in driving innovation and economic growth by providing necessary funding for young companies with innovative ideas.

Schwarzman also emphasizes the importance of due diligence when it comes to investing in startups. This involves thoroughly researching the market potential, management team, and financials of a company before making an investment decision. According to him, this process helps investors identify promising opportunities while minimizing risks.

Furthermore, Schwarzman stresses the need for patience when it comes to venture capital investments. Startups often take time to grow and become profitable, so investors must have a long-term mindset rather than expecting quick returns.

In addition to these insights, Schwarzman also advises aspiring entrepreneurs looking for venture capital funding to focus on building strong relationships with potential investors. Building trust and rapport can greatly increase their chances of securing funding.

Overall, Stephen Schwarzman’s perspective on venture capital highlights its significance as an engine for innovation and economic growth while emphasizing the importance of careful research and patience in this type of investment.

Understanding Stephen Schwarzman’s Investment Philosophy

Stephen Schwarzman is a renowned American investor and the co-founder of private equity firm Blackstone Group. His investment philosophy is rooted in the belief that one must have a deep understanding of the market and its trends, as well as an ability to identify opportunities for growth and success.

At the core of Schwarzman’s investment strategy is his emphasis on thorough research and analysis. He believes in taking a hands-on approach to investing, rather than relying solely on data or financial models. According to Schwarzman, this allows him to gain a deeper understanding of potential investments and make informed decisions based on his own insights.

Additionally, Schwarzman values long-term partnerships with companies rather than short-term gains. He prioritizes building strong relationships with management teams and working closely with them to drive growth and innovation within their businesses. This collaborative approach has proven successful for both Schwarzman and his portfolio companies.

Another key aspect of Schwarzman’s investment philosophy is risk management. He recognizes that every investment carries some level of risk, but he mitigates this by diversifying his portfolio across various industries and asset classes. This allows him to weather economic downturns while still maintaining steady returns over time.

In summary, Stephen Schwarzman’s investment philosophy revolves around thorough research, collaboration with partners, long-term thinking, and effective risk management strategies. These principles have not only led him to massive success as an investor but also serve as valuable lessons for any aspiring investor looking to achieve sustainable growth in their own portfolios.

Stephen Schwarzman on the Current State of Venture Capital

Stephen Schwarzman, an eminent figure in the world of finance and investment, has shared insightful perspectives on the current state of Venture Capital. He asserts that this domain is buzzing with new opportunities, yet fraught with challenges that demand innovative solutions. At its core, Venture Capital is all about infusing start-ups with much-needed funds to fuel their growth and innovation. In today’s environment, it’s more important than ever for investors to identify potential ‘unicorns’ — rare startups projected to hit a billion-dollar valuation.

In Schwarzman’s view, two significant shifts are redefining the landscape of venture capital: increased competition and technological disruption. With more funds entering the scene every day, securing lucrative deals has evolved into an intense race against time.

- The first shift involves a surge in institutional investors seeking high returns.

- The second shift follows from cutting-edge tech trends like artificial intelligence (AI), blockchain technology and e-commerce which are shaping future market demands.

Venture capitalists need to be agile enough to pick up on these emerging trends quickly or risk missing out on transformative opportunities. Even amidst this cut-throat competitiveness, Schwarzman remains optimistic about uncovering breakthrough ideas if one invests wisely and stays patient — a testament to his unwavering belief in human potential for creativity and innovation.

Read also: Has Oracle Corporation merged with any other companies?

Key Strategies for Aspiring Investors: Insights from Stephen Schwarzman

Investment Strategies for Aspiring Investors

Stephen Schwarzman, an iconic figure in the field of investment and co-founder of Blackstone Group, shares some key strategies that can be extremely beneficial for aspiring investors. His words ring true: “success doesn’t just happen. It’s not a matter of luck but design.” He emphasizes on the importance of having clear goals combined with thorough research.

- Firstly, he suggests investing time in understanding thoroughly what you’re getting into – “knowledge is power”. Reading financial news, studying market trends, analysis and forecasts should become part of your daily routine.

- Secondly, Schwarzman talks about diversifying investments as it reduces risk exposure. Putting all your eggs in one basket could be disastrous! Spread out your investments across sectors to mitigate risks and optimize profits.

Cultivating a patient mindset is another piece of advice from Schwarzman that resonates strongly with novice investors. Investing isn’t so much about quick gains as it is about steady growth over time.

The Power Of Patience In Investment

Schwarzman asserts that ‘patience’ plays a vital role in successful investing. The stock market may behave erratically at times; however, panic selling or impulsive buying seldom leads to profit. Steady investments backed by sound knowledge and patience are more likely to reap rewards.

A resilient investor views down periods as opportunities rather than threats; they buy when prices are low during bearish phases only to sell them off when prices soar during bullish markets.

- In conclusion,Schwarzman advises novice investors not just to invest their money but also invest their time for learning continually because success comes from knowing more than others do!

Building a Multi-Billion Dollar Empire: The Role of Strategic Investments

Some may say that money makes the world go round, but if we’re being realistic, it’s not just about having funds – it’s about knowing what to do with them. Building a multi-billion dollar empire is no minor feat; behind every successful enterprise lies an intricate web of strategic investments, each one meticulously planned and executed. These investments become the stepping stones leading towards growth and expansion.

Let’s delve a little deeper into this subject by discussing some key strategies often employed:

–Focusing on high-potential industries: This involves identifying sectors expected to grow rapidly in the future. For instance, technology and renewable energy are currently seeing massive growth potential.

–Diversification: Investing all your eggs in one basket has never been a wise approach. Successful magnates spread their investments across various options to hedge against risk.

–Innovation: With rapid advancements in technology and shifting consumer preferences, companies stay relevant by investing heavily in research & development.

This isn’t simply throwing money around; it’s making thoughtful decisions based on thorough market analysis.

It’s all well and good gazing up at towering empires from our modest vantage point below – yet when we truly comprehend how these colossal entities came into existence through skillful investment navigation; well that really puts things into perspective! So next time you hear of someone building a multi-billion dollar empire remember: there’s more than meets the eye – there’s strategy involved.

Stephen Schwarzman on venture capital

Stephen Schwarzman on venture capital

You may also like: Coca-Cola joint venture with other companies

Stephen Schwarzman’s Predictions and Forecasts for Venture Capital

Stephen Schwarzman, a renowned name in the world of finance, founder and CEO of Blackstone Group, has made some noteworthy predictions for venture capital. Venture Capital is that magic wand which can turn brilliant ideas into successful startups. In his bestseller “What It Takes: Lessons in the Pursuit of Excellence”, he shares his insightful perspectives based on years of experience and success in the realm of private equity.

Schwarzman believes in an aggressive yet calculative approach to venture capital. He highlights three core areas to focus on:

- Data-driven decision making: With growing technological advancements, companies have access to vast metrics which can guide investments. By analyzing patterns and trends, one can make well-informed decisions.

- Global expansion as a part of growth strategies: To truly blossom, businesses should be open to exploring new markets beyond their domestic boundaries.

- Innovations driving the future: Technology-based start-ups could bring about transformative changes that reshape industries.

In addition to these key points, he also emphasizes on patience as a virtue in this high-stakes game where immediate success isn’t guaranteed.

Venture capitalists who heed Schwarzman’s advice may find themselves poised for significant gains. There’s no denying his track record or ability to spot potential winners early on; after all, many refer to him as modern finance’s Midas. As we gear up for more breakthroughs across sectors like AI technology, biotech research and clean energy solutions – prognostications from stalwarts like Schwarzman will continue being extremely valuable guides navigating through complex investment landscapes.

Conclusion: Applying Lessons from Stephen Schwarzman to Your Own Venture Capital Ventures

In his illustrious career, Stephen Schwarzman, co-founder of Blackstone Group, has become known for making astute venture capital (VC) decisions. His knack for identifying promising opportunities and strategically investing in them serves as a beacon to others in the VC realm. There are several lessons we can extract from Schwarzman’s philosophy that could significantly enrich your own VC ventures.

First off, Schwarzman emphasizes the importance of diligence and detail. This means thoroughly investigating potential investments; understanding their value proposition, business model, industry positioning, competitive landscape – everything down to the smallest detail that could impact its success or failure. For Schwarzman it’s not just about injecting capital into a startup but nurturing it with knowledge and insights.

- Risk Management: Another crucial lesson from Schwarzman is risk management. He advises keeping an eye on market trends and economic indicators to anticipate possible downturns.

- Diversification: Investing across various sectors helps balance out potential losses should one venture fail.

- Patient Capital: Lastly, remember that good things come to those who wait. It takes time for businesses to grow.

In conclusion: by applying these lessons from Stephen Schwarzman – diligence in research before investment; managing risk through trend analysis and diversification; patience while awaiting returns – you can enhance your own venture capital ventures.

Read also: joint ventures vs. mergers and acquisitions