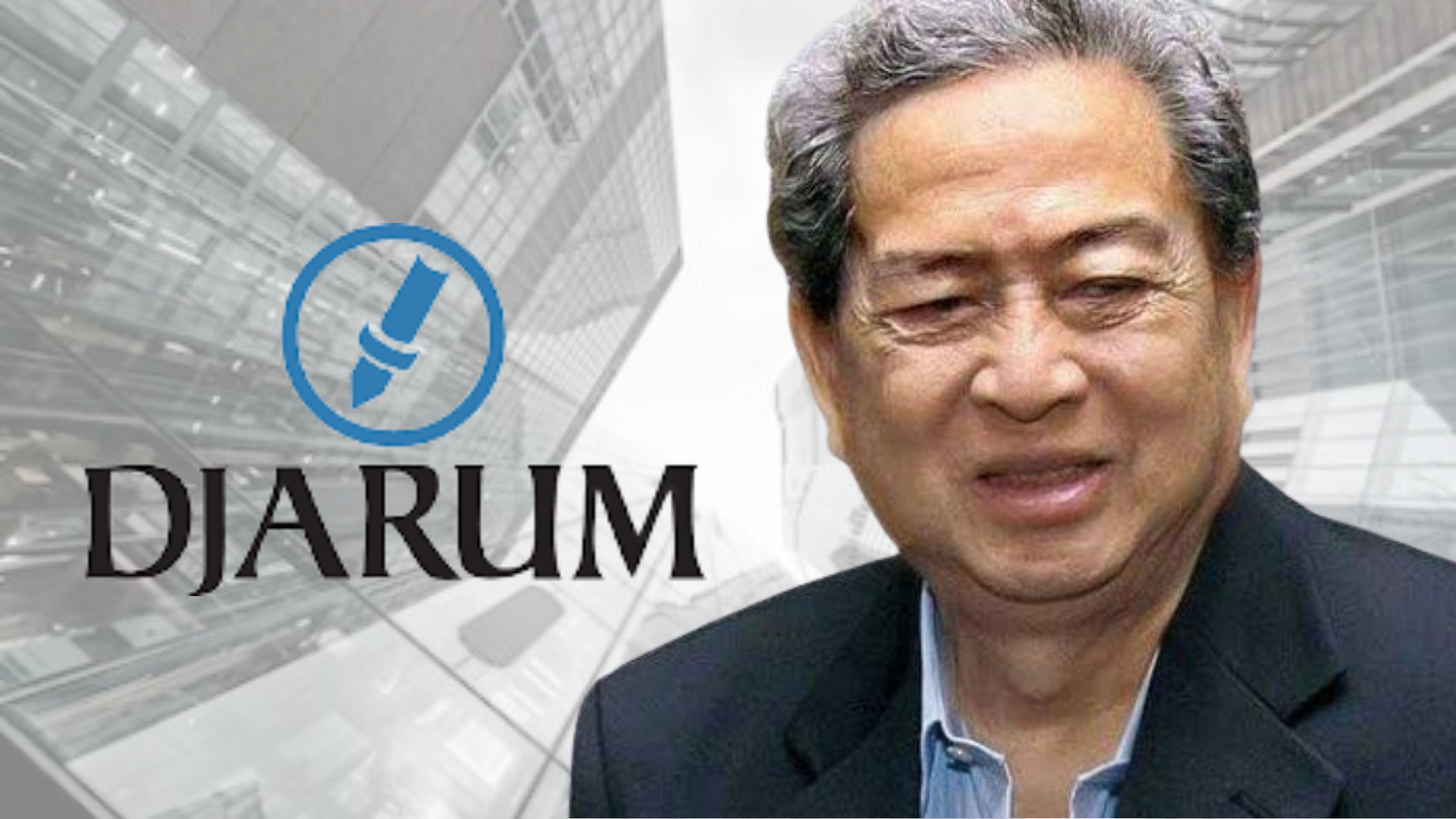

Robert Budi Hartono, one of the richest men in Indonesia with a net worth of $23.8 billion according to Forbes, has made his fortune through various ventures including consumer goods and banking. However, what does this billionaire think about venture capital? In this article, we’ll take a closer look at the insights and opinions of Robert Budi Hartono on venture capital as an investment strategy.

As someone who has achieved tremendous success in the business world, it’s safe to say that Robert Budi Hartono knows a thing or two about investing. And when it comes to venture capital, he has some interesting thoughts that can benefit aspiring entrepreneurs and investors alike. So let’s dive into the mind of this billionaire investor and see what he has to say about venturing into venture capital!

So, What Robert Budi Hartono thinks about venture capital?

Robert Budi Hartono, a billionaire investor and one of the richest people in Indonesia, has a unique perspective on venture capital. While he acknowledges its potential for high returns, he also recognizes the risks involved.

Hartono believes that venture capital is not suitable for everyone. It requires a certain level of expertise and experience to be successful in this field. He advises aspiring investors to thoroughly research and understand the market before diving into it.

But despite the challenges, Hartono sees great potential in venture capital. He believes that it is an essential tool for stimulating economic growth and innovation. By providing funding to startups and small businesses with promising ideas, venture capitalists can help bring new products and services to the market, creating jobs and driving progress.

Hartono also emphasizes the importance of building strong relationships with entrepreneurs when investing in their ventures. As someone who has been successful in various industries such as tobacco, banking, real estate, and technology through his company Djarum Group, Hartono knows firsthand how crucial partnerships are for success.

In addition to his insights on venture capital as an investment strategy, Hartono also values giving back to society through philanthropy. He believes that successful individuals have a responsibility to use their wealth for good causes and make a positive impact on society.

In conclusion, Robert Budi Hartono sees both opportunities and challenges in venture capital but ultimately views it as an important tool for driving economic growth and innovation. With his vast experience as a businessman and investor combined with his passion for philanthropy, his thoughts on this topic hold valuable insights for those interested in venturing into this field.

Understanding Robert Budi Hartono’s Investment Philosophy

Robert Budi Hartono, a billionaire businessman from Indonesia, is known for his successful investment strategies and impressive portfolio. His approach to investing has been shaped by his personal experiences and cultural background, making it unique and effective. Let’s take a closer look at Robert Budi Hartono’s investment philosophy.

First and foremost, Hartono believes in the power of diversification when it comes to investing. He spreads out his investments across different industries and sectors, minimizing the risk of losses if one particular industry faces challenges. This also allows him to take advantage of various opportunities that arise in different markets.

Moreover, Hartono is a patient investor who understands that success does not come overnight. He takes a long-term view with his investments rather than chasing short-term gains. This allows him to weather any market fluctuations or economic downturns without panicking or making impulsive decisions.

Another key aspect of Hartono’s philosophy is disciplined decision-making. He thoroughly researches before making any investment decisions and sticks to his predetermined strategy even during uncertain times. This helps him avoid emotional reactions in response to market trends and maintain consistency in achieving his long-term goals.

Additionally, Hartono emphasizes the importance of constantly learning about new technologies and industries as they emerge. He adapts quickly to changing markets and stays ahead of the curve by educating himself about emerging trends.

In summary, Robert Budi Hartono’s investment philosophy combines diversification, patience, discipline, and continuous learning for long-term success in the ever-changing world of finance.

Assessing the Role of Risk in Venture Capital According to Robert Budi Hartono

Assessing the Role of Risk in Venture Capital, as per Robert Budi Hartono’s perspective, presents a deeply layered narrative. As one of Indonesia’s wealthiest individuals and a savvy business tycoon, he has significant insights into this topic.

Risk management, to him, is like navigating through a stormy sea. Venture capitalists must have the ability to predict economic tremors and adjust their sails accordingly. This does not mean avoiding risks at all costs but rather understanding and managing them effectively for maximum return on investment.

- Understanding Risk: Hartono believes that risk is an inherent characteristic in venture capital investments. He suggests evaluating each potential investment opportunity thoroughly before making any decisions. Understanding the nuances of every deal — including details about the market condition, competition scenario, scale-up possibilities of startups—is critical.

- Managing Risk: According to Hartono, managing risk doesn’t mean eliminating it entirely—but controlling it strategically with informed decision-making processes influenced by meticulous research and forecasting models. A balance between high-risk-high-return projects and safer ones should also be maintained.

Venture capitalism isn’t just about picking promising companies; it’s also about anticipating downturns or even failures—what Hartono refers to as “damage control.” His nuanced perspective paints a realistic portrayal of venture capitalism’s harsh realities behind its glamorized exterior.

In conclusion, Robert Budi Hartono views risk as an integral part of venture capitalism, which requires careful analysis and strategic management for successful outcomes. The real test lies not in completely evading risks but skilfully steering through them while maintaining steady growth trajectories—a philosophy he diligently practices himself.

Read also: joint ventures in Furniture manufacturing industry

Robert Budi Hartono’s Perspective on Importance of Innovation in Venture Capital Investments

Robert Budi Hartono, a renowned businessman and seasoned investor, has always strongly emphasized the pivotal role that innovation plays in venture capital investments. In his eyes, it is not merely about injecting funds into a startup or young company but rather nurturing an environment that fosters creative thinking and progressive ideas. “The future of any business,” he often says, “is clearly entwined with its capacity to innovate“. In other words, the most promising ventures aren’t necessarily those that are already established or profitable but those capable of breaking new grounds through revolutionary concepts and novel solutions.

In accordance with this philosophy,

- Hartono seeks out investment opportunities not based on immediate financial returns alone,

- but puts significant weight into the potential for breakthroughs and transformative impacts in their respective fields.

Moreover, he actively encourages entrepreneurs to adopt an innovative mindset by consistently challenging conventional wisdoms and daringly venturing into uncharted territories. He believes such bold steps can ultimately bring forth substantial game-changing advancements which can catapult a venture from being just another player in the field to becoming industry leaders. As Robert Budi Hartono wisely posits: “Innovation isn’t just beneficial; it’s absolutely essential.” It’s clear as day – for him, an investment without innovation is like taking two steps forward only to take three back!

How Robert Budi Hartono Sees The Potential Returns in Venture Capital

Robert Budi Hartono, a prominent business magnate hailing from Indonesia, has always been one to seek opportunity where others may not. His vision extends beyond the traditional realms of banking and tobacco industries—areas he is well established in—to the innovative world of venture capital. To him, venture capital isn’t just about injecting funds into startups; it’s an investment in bright minds with transformative ideas and revolutionary products that can change the future.

Hartono understands that venture capital investments are high-stakes gambles. Despite their risky nature, they promise exponential returns if they hit big. The potential for these outsized returns stems from getting involved early when companies are still in their infancy stage.

- The joy comes from seeing businesses grow exponentially under your guidance,

- The thrill lies within nurturing these budding ventures until they bloom,

These aspects truly resonate with his entrepreneurial spirit. He views venture capitalism as not just investing money but also involves time, expertise and strategic thinking—a veritable gold mine waiting to be tapped.

What Robert Budi Hartono thinks about venture capital

What Robert Budi Hartono thinks about venture capital

You may also like: What Mark Zuckerberg thinks about joint ventures

Robert Budi Hartano’s Advice for Newcomers in the Venture Capital Space

Entering the realm of venture capital can seem daunting, but Robert Budi Hartano, one of Indonesia’s most successful businessmen and billionaire, offers practical advice for newcomers. He emphasizes that understanding your market is paramount. Like exploring a new city or learning a fresh language, you must make an effort to grasp its nuances and subtleties – demographics, trends, customer behavior. His words echo the importance of not merely scratching the surface. Strategy in this space requires diving deep into market analysis and dissecting consumer behaviors.

For those eager to thrive in the venture capital arena following Mr. Hartano’s steps; he recommends building strong relationships within industry circles as well as with potential clients. The venture capital landscape is built on trust and credibility which acts as cornerstones for any successful business transaction.

- Foster partnerships with industry influencers.

- Cultivate a reputation for transparency.

- Nurture relationships through consistent communication.

The power of networking cannot be overstated! Every conversation could lead to a jewel waiting to be discovered – perhaps an innovative start-up seeking funding or even seasoned entrepreneurs keen on offering mentorship.

Remember that venture capital isn’t just about quick returns; it’s about nurturing long-term investments and seeing them grow from fledgling ventures into powerful entities.

Conclusion: Applying Robert Budi Hartono’s Insights to Your Own Investment Strategy

Investing wisely is not just about knowing where to put your money, but also understanding when and how. As we delve into the insights shared by Robert Budi Hartono, one of Indonesia’s most prosperous entrepreneurs, we get a clearer picture of what smart investing looks like. The successful businessman didn’t just amass his wealth overnight; it was a carefully orchestrated strategy that spanned over decades.

Hartono’s investment philosophy centers on persistence, risk management, and diversification. He believes in staying the course despite market fluctuations, demonstrating resilience during economic downturns. Recognizing that all investments carry some degree of risk, he mitigates this by spreading his investments across various sectors. These strategies can be distilled into three main points:

- Persistent investment: Keep an eye on long-term goals rather than being swayed by short-term market trends.

- Risk Management: Understand your own risk tolerance level and invest accordingly.

- Diversification: Spread out your investments to reduce exposure to any single asset or risk.

By applying these principles from Robert Budi Hartono’s playbook to your own personal circumstances – analyzing the risks you are comfortable with, maintaining patience for sustained growth over time, and ensuring diversification within your portfolio – you too could potentially enhance your financial future significantly.

Read also: who are Amazon Inc’s joint venture partners