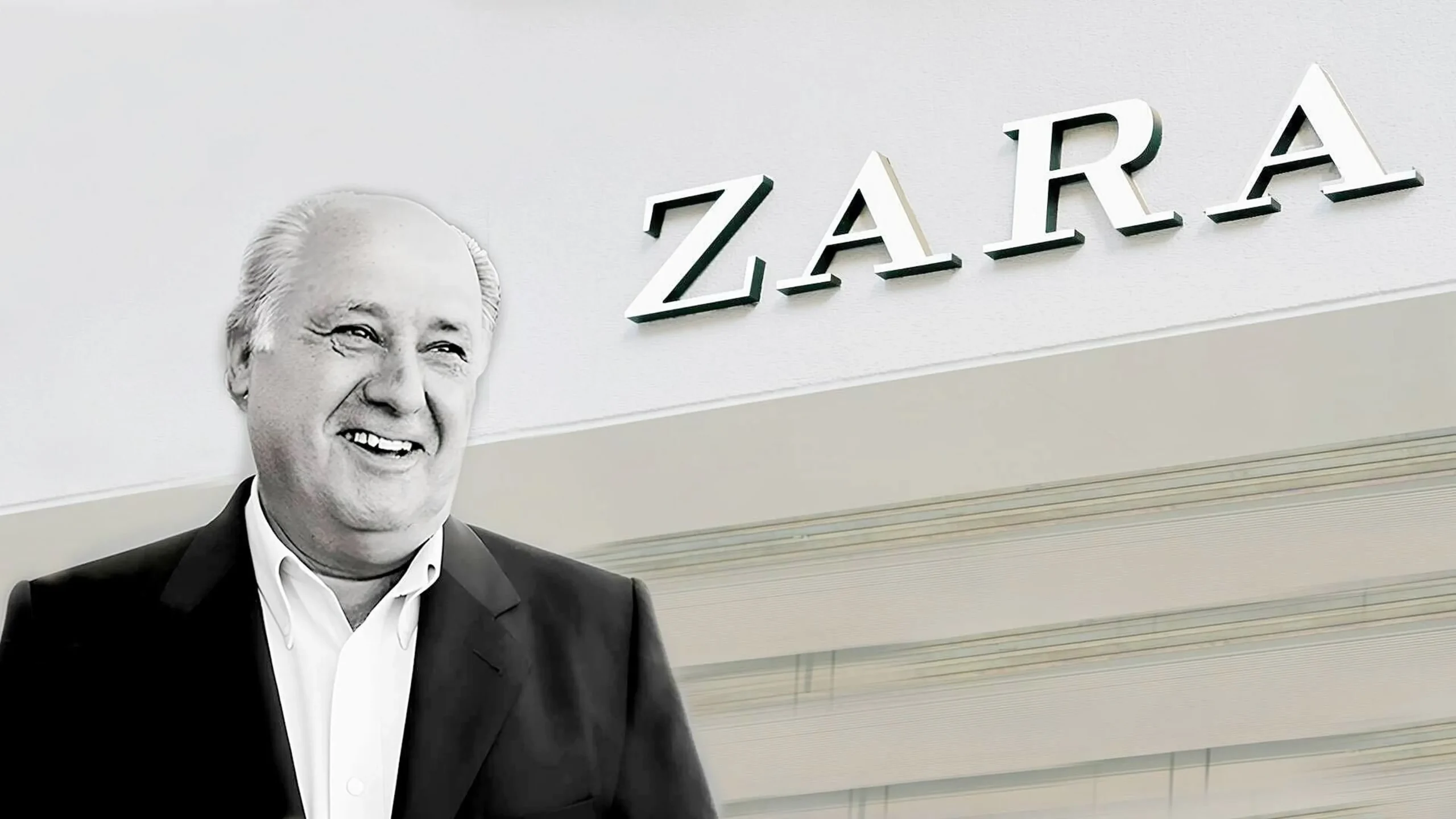

Curious about what Amancio Ortega, the richest retailer in the world, thinks about venture capital? As a successful entrepreneur, Ortega has built his fortune through strategic investments and business savvy. But when it comes to venture capital, what does he have to say? In this article, we’ll explore Ortega’s insights on this popular form of funding for startups. From his personal experiences with investing to his thoughts on its impact on the retail industry, find out everything you need to know about what Amancio Ortega thinks about venture capital. Whether you’re an aspiring entrepreneur or just interested in learning more about the world of finance, keep reading for some valuable insights from one of the most successful businessmen in history!

So, What Amancio Ortega thinks about venture capital?

Amancio Ortega, the founder of Spanish retail giant Inditex and one of the wealthiest people in the world, has a unique perspective on venture capital. While he may not be directly involved in the world of startups and venture funding, his success as a self-made billionaire offers valuable insights into what it takes to build a successful business.

One key takeaway from Ortega’s approach is his focus on simplicity and efficiency. He famously started out with just a few sewing machines and some basic materials, working tirelessly to create high-quality garments at affordable prices. This mindset carried over into his business operations as well – keeping things streamlined and avoiding unnecessary expenses.

In terms of venture capital, Ortega’s philosophy aligns with this idea of simplicity. He believes that entrepreneurs should focus on building sustainable businesses rather than seeking out large sums of investment capital. In an interview with Forbes magazine, he stated that “the best way to grow is by reinvesting your own profits.”

Ortega also emphasizes the importance of staying true to your vision and not getting caught up in outside influences or trends. As he once said, “I never wanted to be fashionable; I want my clothes to last.” This mentality can be applied to startups as well – instead of chasing after the latest fads or trying to please investors, entrepreneurs should stay focused on their original mission and values.

Additionally, Ortega stresses the importance of constantly evolving and adapting in order to stay ahead in an ever-changing market. He famously moved away from traditional seasonal collections for Zara (Inditex’s flagship brand) and implemented a fast-fashion model where new styles are constantly being introduced based on customer demand.

Overall, Amancio Ortega’s thoughts on venture capital highlight the value of simplicity, sustainability, staying true to your vision, and constant innovation – all factors that have contributed greatly to his immense success as a retailer.

Amancio Ortega’s Personal Experience with Venture Capital

Amancio Ortega is a name that rings out in the world of fashion and finance. This incredibly successful entrepreneur from Spain laid the foundation for Inditex, one of the biggest retail conglomerates globally, primarily known for its most popular brand, Zara. However, when focusing on Ortega’s journey to business prosperity, it becomes clear just how crucial venture capital has been in shaping his remarkable career.

At first glance, it might seem like Ortega sailed smoothly into success. Yet he had to maneuver through many challenges along the way. A significant obstacle was gathering enough money to fund his ambitious projects.

The man did not come from wealth; he started as a shirtmaker working at a small scale store named Confecciones Goa. It was here where he got his first taste of running a business and envisioned creating something bigger.

When envisioning an expansion plan for what would later become Inditex, Amancio found himself needing more funds than he could accumulate alone. Here is where venture capital – finance provided by investors to startups with long-term growth potential – played its part.

- Venture capitalists saw promise in Ortega’s vision, providing him with the financial backing necessary to take his project off paper and into reality.

- This injection of funds allowed him to expand beyond local confines, transforming Confecciones Goa from a local store into an international powerhouse famous worldwide as Zara.

In conclusion, while Amancio Ortega’s hard work and innovative thinking were key elements behind his success story; without Venture Capital stepping up at critical junctures – presenting opportunities that otherwise would have remained out-of-reach –his ascent might not have been quite so meteoric.

The Role of Venture Capital in Zara’s Success

The Role of Venture Capital in Zara’s Success

In the world of fashion, Zara stands as a towering success story. A part of this triumph can be attributed to the significant role played by venture capital. In the early stages of Zara’s development, venture capitalists saw tremendous potential in its unique business model and poured funds into fostering its growth. This financial backing was crucial in allowing Zara to take risks and pioneer innovative approaches within the fast-fashion industry.

Venture capital investment gave Zara more than just fiscal support; it also provided them with strategic guidance that reshaped their path towards being a global powerhouse. The hands-on operational involvement from their investors helped refine their supply chain management – an attribute they’re renowned for today. It allowed them to swiftly respond to changing trends and achieve quick turnaround times (

- A nimble response mechanism that has set them apart in a hyper-competitive market.

). Furthermore, these venture capitalists built strong networks; connecting Zara with valuable partnerships and collaborations that have since enhanced its brand standing worldwide. Hence, we see how venture capital played an instrumental role not just financially but also strategically – acting as catalysts propelling Zaratowards monumental success.

Read also: Does Meta Platforms, Inc. use joint ventures?

Understanding Amancio Ortega’s Investment Strategy

Understanding Amancio Ortega’s Investment Strategy

Amancio Ortega, the mastermind behind the world-renowned fashion brand – Zara, is well recognized for his exceptional investment strategy. This Spanish billionaire operates with an intriguing blend of wisdom and daring moves that has seen him rise as one of the wealthiest persons in the world. An integral part of Ortega’s strategy lies in his ability to perceive value where others do not, thus seizing lucrative opportunities even during economic downturns.

- A Diverse Portfolio:

Ortega believes profoundly in diversification as a critical aspect of investing. Rather than putting all eggs into one basket, he spreads out his investments across varying sectors such as real estate, renewable energy, and water management companies amongst others. The logic here is simple – if one sector underperforms or faces a downturn due to unpredictable market conditions, another can compensate for it.

A fascinating feature about Ortega’s investment approach involves minimal public exposure and remaining discreet about his dealings; he seldom gives interviews or makes media appearances. He avidly prefers actions over words which translates into quick decision-making on potential investments without being influenced by extraneous factors or opinions.

- Sensible & Long-Term Approach:

Another crucial element of Amancio’s investment style includes making sensible decisions while focusing on long-term returns rather than short-term gains. His patient demeanor coupled with strategic thinking allows him to make prudent choices that yield substantial returns over time.

Indeed, understanding Amancio Ortega’s investment strategy provides valuable insights into effective money management practices – emphasizing diversity in portfolio allocation and maintaining a long-term focus despite inevitable market turbulence along the way.

Amancio Ortega on the Importance of Timing and Opportunity in Venture Capital

Amancio Ortega, the founder of Zara and one of the richest people in the world, is a firm believer in the power of timing and opportunity when investing in venture capital. He likens it to surfing; you have to ride the right wave at just the right time to make it to shore. Waiting too long or jumping too soon can result in missed opportunities or wasted investments.

Ortega’s own success story is testimony to his philosophy. His knack for seizing opportunities at their prime has led him from making housecoats out of quilted bathrobes, to establishing Zara, now a fashion powerhouse with over 2,000 stores across 96 countries.

Venture capital investment, according to Ortega, requires more than just money — it needs impeccable timing and an eye for spotting singular opportunities. You can’t hold back waiting for ‘the perfect moment,’ because there might never be such a thing. Likewise, rushing into an investment without examining its potential may lead you down an unfortunate path.

- Precision: Like hitting a moving target with a dart – impractical if not impossible without precision.

- Insight: Being able to see beyond what’s presented – akin to reading between lines.

- Risk tolerance: Possessing courage that allows one not only take risks but also bear possible losses.

Ortega believes that these are among some important attributes needed by every venture capitalist — after all, no sailor ever discovered new lands without losing sight of shore first!

What Amancio Ortega thinks about venture capital

What Amancio Ortega thinks about venture capital

You may also like: What George Soros thinks about joint ventures

How Amancio Ortega Views Risk In Relation to Venture Capital

Amancio Ortega, a seasoned business magnate revered for his establishment of the colossal fashion group, Zara, holds an intriguing perspective on risk in relation to venture capital. He views risk not as a calamitous threat looming over investments but rather, as an essential part of the journey towards success. Simply put, without any sense of danger or uncertainty, there would be no room for growth and innovation. It’s this acceptance and embracement of risk that contributes significantly to Ortega’s impressive entrepreneurial mindset.

- Risk Tolerance: In Ortega’s playbook, high-risk tolerance is considered a valuable asset for any venture capitalist. His approach involves investing heavily but wisely in startups with significant potential even though they might be perceived as risky by conventional standards.

- Innovation Over Security: While many investors prioritize security above all else, Ortega tends to place greater emphasis on innovation when deciding where to direct his funds. For him, companies that are bold enough to break new ground often hold more promise than those adhering strictly to tried-and-true methods.

- Diversification: To mitigate some degree of risk involved in venture capitalism, Ortega advocates diversification – spreading resources across various industries and markets instead of funnelling everything into one area.

In essence, Amancio sees risks in venture capital as necessary stepping stones; hurdles that challenge and ultimately enhance decision-making skills while fostering resilience among investors.

His philosophy underscores the notion that being frightened by risks is counterproductive – it’s about understanding them well enough so you can play smartly around them.

Conclusion: Applying Amancio Ortega’s Insights to Your Own Investment Strategies

Not everyone can become a billionaire like Amancio Ortega, but that’s no reason not to learn from his methods! The co-founder of Inditex, the parent company of Zara, has made some clever investment decisions over the years. You might be surprised how much you can apply his insights to your own investment strategies.

Ortega has often shown a preference for real estate investments. He appreciates tangible assets and values properties for their potential long-term returns. This doesn’t mean he buys any property; he famously focuses on prime locations with high traffic density, ensuring steady rental income and appreciation.

- Lessons here? Consider adding real estate to diversify your portfolio.

- Aim for high-quality properties in great locations.

In addition to investing in physical assets, Ortega reinvests profits back into his business instead of distributing them as dividends. This focus on growth sustains future earnings power – an important aspect key investors should take note of.

In applying these principles to our own investment strategies, we should remember Ortega’s commitment to taking calculated risks and making long-term bets. His focused approach—seeking quality over quantity—not only applies to fashion but also resonates in the world of investing.

- Borrow this mindset by re-investing profits into growing ventures or promising stocks.

- Absorb Ortega’s penchant for pursuing sustainable growth rather than instant gratification.

Learning from successful individuals like Amancio Ortega offers insightful lessons that help shape our perspectives towards investment strategies. Remember it’s not about being wealthy overnight; it’s about building wealth strategically over time through wise decision-making–just as Mr.Ortega did!

Read also: what is an international joint venture