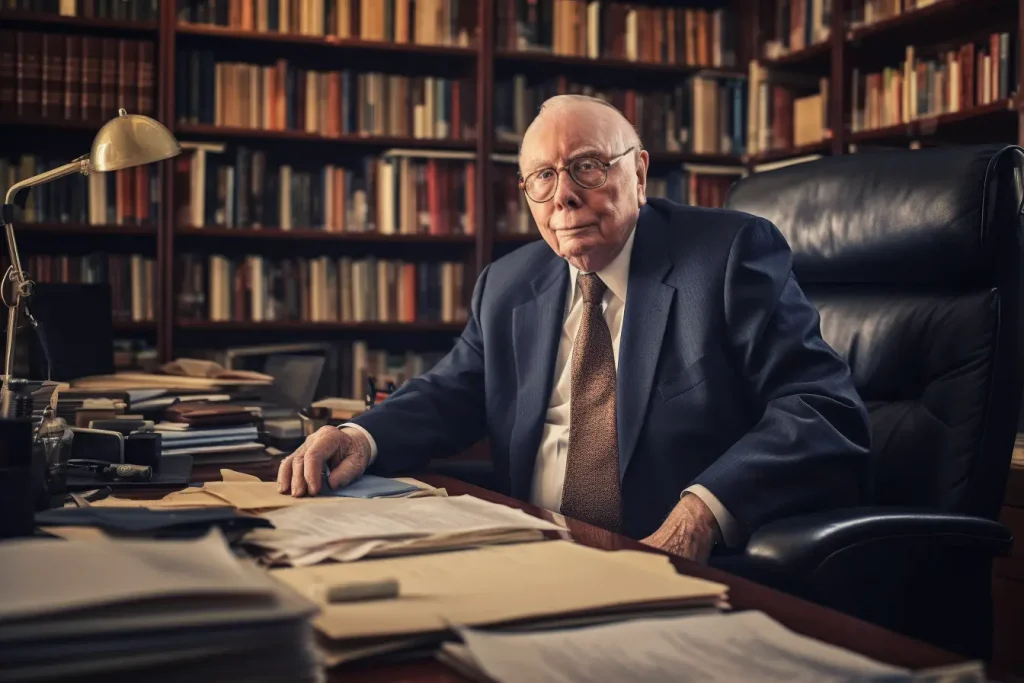

Charlie Munger, famed billionaire investor and business partner of Warren Buffett, was known for his sharp insights and clever investment strategies. But did you know he also had valuable advice when it comes to venture capital? If you’re interested in the world of venture capital and want to learn from one of the best, then this article is for you.

In this piece, we’ll delve into Charlie Munger’s thoughts on venture capital and uncover insider tips that can help you become a successful VC investor. We’ll discuss his personal experiences with investing in start-ups, his approach to assessing risks and opportunities, and how he believes investors can achieve long-term success in the ever-changing landscape of the venture capital industry.

Whether you’re an aspiring VC or simply looking to gain some knowledge about this exciting field from a seasoned pro, this article will provide valuable insights that only someone like Charlie Munger can offer. So get ready to take notes as we dive into Charlie Munger’s wisdom on venture capital!

So, Charlie Munger on venture capital?

Charlie Munger, the billionaire investor and vice chairman of Berkshire Hathaway, was known for his sharp wit and wise investment strategies. While he may be best known for his partnership with Warren Buffett, Munger also had valuable insights on venture capital. Munger shared some insider tips and insights on the world of venture capital. He emphasized the importance of having a strong team when investing in startups, stating that “It’s not just about finding good companies, it’s about finding good people.”

Munger also stressed the importance of diversification in venture capital investments. He advised investors to spread their money across multiple startups rather than putting all their eggs in one basket. This strategy can help mitigate risk and increase chances of success.

Another key insight from Munger was the importance of doing thorough research before making any investment decisions. He recommended reading widely and constantly learning about different industries to make informed choices.

When asked about what qualities he looks for in a startup founder, Munger highlighted intelligence and integrity as crucial traits. He also mentioned that he prefers founders who have failed at least once before because they have learned important lessons from their mistakes.

In addition to these tips and insights, Charlie Munger emphasized patience when it comes to venture capital investments. He acknowledged that it takes time for startups to grow and see returns, but believes that patience pays off in the long run.

Overall, Charlie Munger’s perspective on venture capital provides valuable guidance for both seasoned investors and those looking to enter this field. With his wealth of experience and successful track record in investing, his advice should not be taken lightly by anyone interested in this industry.

Charlie Munger’s Approach to Venture Capital

Charlie Munger, the renowned investor and partner to Warren Buffett at Berkshire Hathaway, is well-known for his unconventional approach to investing. While many investors focus on buying stocks in established companies with steady growth potential, Munger takes a different approach – he invests in venture capital.

Venture capital is a type of financing that provides funds to early-stage startups and small businesses with high growth potential. Unlike traditional investing, which focuses on purchasing shares in already established companies, venture capital involves taking a chance on new and unproven businesses. This may seem like a risky move to some investors, but Munger sees it as an opportunity for greater returns.

Munger’s approach to venture capital is based on two key principles – patience and diversification. He believes that by being patient with investments and allowing them time to grow, he can reap greater rewards in the long run. This is especially true for startup companies that may take years before they become profitable. Additionally, Munger spreads his investments across multiple startups rather than putting all his money into one company. By doing so, he minimizes risk and increases his chances of hitting big winners.

Moreover, another aspect of Charlie Munger’s approach is his emphasis on understanding the business model of each startup before making any investment decisions. He looks for companies with sustainable competitive advantages (also known as “moats”) that will allow them to thrive even when faced with competition or economic downturns. This careful selection process ensures that only the most promising ventures receive funding from him.

In conclusion, Charlie Munger has made a name for himself not only through his partnership with Warren Buffett but also through his unique perspective on investing in venture capital. His patience, diversification strategy, and focus on understanding business models have proven successful time after time – solidifying him as one of the greatest investors of our time.

Unpacking Charlie Munger’s Investment Philosophy

Charlie Munger, the esteemed vice chairman of Berkshire Hathaway, has earned much recognition in the world of investments. His philosophy is built upon a foundation that goes beyond mere numbers. Instead, he adopts a comprehensive analytical approach towards decision-making.

Munger’s doctrine revolves around two major principles: Patience and Discipline. He firmly believes that one must not rush into making hasty decisions but wait for opportunities to present themselves naturally. This practice requires immense discipline to stick with even when faced with exciting investment prospects. But, his wisdom dictates that impulsive actions often lead to regrettable outcomes.

- Acknowledging ignorance: Munger emphasizes the importance of identifying one’s limitations and areas where they lack knowledge.

- Focused Approach: He encourages keeping your focus on just a few stocks as opposed to spreading too thin over many.

- Maintain Rationality: One needs to stay rational and logical while making any investment decisions under Munger’s philosophy.

The essence of Charlie Munger’s investment theory lies in its simplicity; it advocates for patience, acknowledges human flaws, values focused concentration over diversification, and promotes logical thinking above all else.

An intriguing facet of Charlie’s strategy is his regard for ‘inverse thinking.’ The concept suggests understanding what you want by examining what you don’t want first. Applying this principle helps avoid grave mistakes which subsequently lands you closer to success automatically! Such clear-cut insight doesn’t come from fleeting market trends or flashy analysis tools but rather through keen observation and innate wisdom – hallmarks of Munger’s successful investing career.

Read also: What Philip Anschutz thinks about venture capitalUnderstanding Risk and Opportunity through the Eyes of Charlie Munger

For many, the name Charlie Munger signifies a beacon of wisdom and insight in the field of business. Munger, vice chairman of Berkshire Hathaway and Warren Buffet’s right-hand man has often instructed others to look at risk not as a barrier but as an opportunity to uncover hidden potential. His unique perception is instrumental for those learning about investing and risk management.

His approach advises us that all risks must be examined from several angles – financial, reputational or even emotional. Understanding this allows one to make prudent decisions when faced with uncertainty in investment ventures. In his words: “Acknowledging what you don’t know is the dawning of wisdom.“

He strongly believes that every opportunity carries some measure of inherent risk which isn’t necessarily something negative. Instead, perceiving them as parts and parcels can help us ascertain whether they are worth pursuing.

- Is it financially justifiable?

- Will it enhance our reputation?

- Does it align with our core personal beliefs?

Munger’s mentality, simple yet profound, encourages us not to avoid risks completely but rather weigh them against potential benefits before making any decision. This thoughtful balance between caution and daring enriches our outlook towards life’s opportunities – teaching us valuable lessons on how we could grow personally and professionally amidst volatile circumstances.

In essence, Charlie Munger’s philosophy embodies the principle that understanding risks pave way for seizing opportunities effectively – a mantra each modern investor should endeavor to comprehend.

Charlie Munger’s Tips for Assessing Startup Potential

Have you ever wondered how industry mogul Charlie Munger evaluates the potential of an up-and-coming startup? The legendary investor uses a unique set of criteria to decide where he wants to put his money. His wise approach relies on looking beyond surface level projections and diving deep into the company’s core values, their long-term vision, and market viability.

Munger’s first tip: Always prioritize substance over hype. Businesses often have flashy presentations filled with impressive statistics and promising forecasts. Yet, Munger advises not to be swayed by these alone but instead focus on the startup’s real value proposition.

• Is their product or service solving a significant problem?

• Do they have a unique solution that sets them apart from competitors?

These are key questions that can help one see through the hype.

In addition, Munger emphasizes understanding the team behind a startup. He believes that strong leadership along with talented and dedicated teams are integral for success. It is important to look at:

• Who are in charge – do they have credibility and relevant experience in the sector?

• How aligned is their vision with what customers really want?

Following this philosophy has helped Charlie Munger achieve incredible success in his investment journey. Emulating his approach may just lead others down similar paths of financial prosperity.

Charlie Munger on venture capital

Charlie Munger on venture capital

You may also like: Who are Nestlé’s joint venture partners?

Lessons from Charlie Munger: Long-term Success in Venture Capital

Charlie Munger, Warren Buffett’s long-time business partner at Berkshire Hathaway, is a well-regarded figure in the investment world. His wisdom and strategies are often sought after by professionals looking for guidance in venture capital. One of his greatest lessons emphasizes the importance of long-term success. He suggests that instead of focusing on immediate profit, investors should consider the lasting impact and potential growth of their investments.

Investing with a short-term perspective can lead to quick returns, but it rarely sets up for sustained success. Munger encourages entrepreneurs to invest not only money but also time and dedication into ventures they truly believe in. The idea is to nurture these ventures like you would care for a growing tree, allowing them the time required to mature fully.

- Patient Capital: Munger’s lessons teach us that ‘patient capital’ is key when pursuing long-term success in venture capital.

- Informed Decisions: Also essential is making informed decisions based on thorough research and understanding rather than rushing into investments due to market pressure or trends.

- Cultural Fit: Lastly, he advises individuals to invest in companies whose values align with theirs – this helps foster mutual respect and commitment between investors and entrepreneurs which ultimately contributes towards longevity.

This approach might be slower-paced compared with other investment methods; however, patience combined with wise decision-making will undoubtedly lead one down the path toward enduring achievement within venture capitalism – as Charlie Munger himself has demonstrated throughout his illustrious career.

Conclusion: Applying Charlie Munger’s Wisdom in Your Venture Capital Journey

Embracing Charlie Munger’s wisdom in your venture capital journey can be a game changer, illuminating the path towards a successful future. This legendary investor, renowned for his sage advice and thinking prowess, has over the years imparted valuable lessons that you can implement to attain entrepreneurial success. From the importance of patience and perseverance in investments to understanding that risks are an integral part of any venture – his insights have shaped many successful business stories.

- Munger advocates for “patient investing”, which entails waiting for opportunities rather than chasing them. Venture Capitalists need this virtue more than anyone else, as it often takes time before startups become profitable.

- The concept of embracing uncertainties also stands out importantly among Munger’s teachings. He emphasizes on the fact that “nothing is certain except uncertainty.”

- Munger’s belief in continuous learning sets him apart from others: he constantly reinforces how important it is to keep expanding your knowledge base in order to make informed decisions.

In conclusion, Munger’s wisdom offers practical strategies for individuals navigating through their venture capital journey. Applying these principles not only enhances decision-making skills but also develops a considerable appreciation for long-term gains over immediate rewards. It encourages us to face challenges with courage and resilience instead of fear or hesitation; thus leading us closer towards our desired goals. So next time you’re contemplating an investment move, remember Mr.Munger’s wise words – they might just hold the keys to your future success!

Read also: jv partner