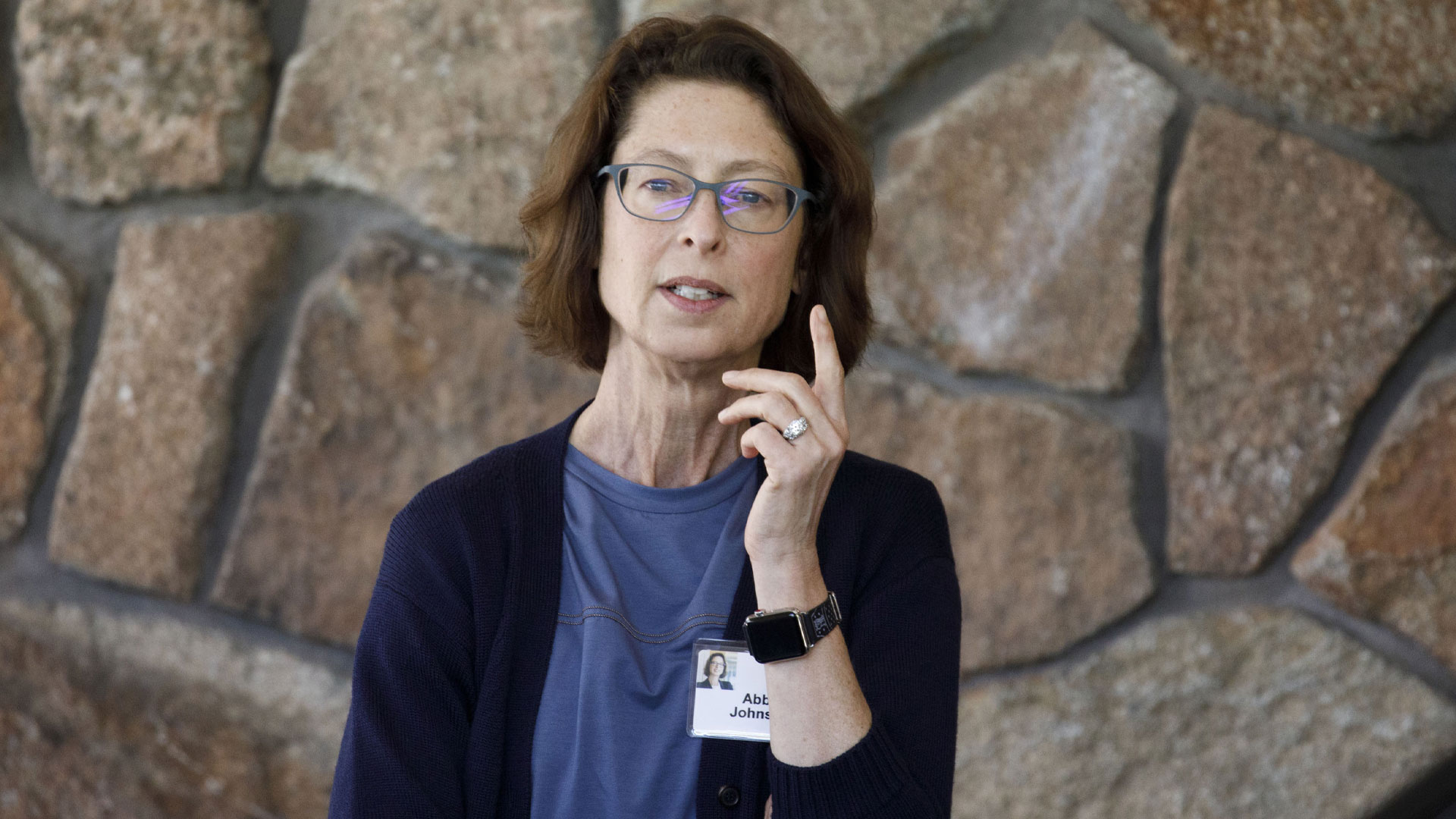

Interested in venture capital? Want to learn from one of the top leaders in the industry? Look no further- Abigail Johnson, the CEO of Fidelity Investments, is here to share her insights on all things venture capital. Whether you’re an aspiring investor or simply curious about this fast-paced and ever-evolving field, I’ve got you covered.

In this article, we’ll delve into Abigail Johnson’s perspective on venture capital, drawing from her extensive experience as a leader in one of the largest asset management companies. We’ll explore everything from her thoughts on current trends and challenges within the industry to tips for success as a venture capitalist. So sit back, grab your notepad, and let’s learn from one of the best in the business!

So, Abigail Johnson on venture capital?

Abigail Johnson, the CEO of Fidelity Investments, has a unique perspective on venture capital. As one of the largest and most successful investment firms in the world, Fidelity has been involved in numerous ventures and startups over the years.

Johnson believes that venture capital is essential for fostering innovation and driving economic growth. She sees it as a way to support entrepreneurs and help them bring their ideas to life. In her role at Fidelity, she has seen firsthand how venture capital can provide critical funding for startups and fuel their growth.

However, Johnson also recognizes that investing in early-stage companies comes with risks. Not every startup will succeed, but she believes that taking calculated risks is necessary for progress and advancement.

In addition to providing financial support, Johnson emphasizes the importance of mentorship in the world of venture capital. She encourages established investors to share their knowledge and experiences with up-and-coming entrepreneurs to help guide them towards success.

Overall, Abigail Johnson sees venture capital as a crucial component of our modern economy. By supporting new ideas and businesses through strategic investments and guidance, she believes we can drive innovation forward and create a better future for all.

Understanding Abigail Johnson’s Journey in the Venture Capital Space

Abigail Johnson is a prominent figure in the venture capital space, serving as the CEO and President of Fidelity Investments. Her journey to this position was not an easy one, but her determination and unwavering passion for finance have led her to become one of the most successful women in the industry.

Johnson’s story begins with her early education at Hobart and William Smith Colleges, where she studied art history. It wasn’t until she interned at Fidelity Investments during college that she discovered her interest in finance. After graduation, she joined Fidelity full-time and quickly climbed the ranks, eventually becoming president of its mutual fund division. Her success at Fidelity caught the attention of many in the venture capital world, leading to her current role as CEO.

One key aspect of Johnson’s journey has been her ability to adapt to changing market trends and technologies. As technology continues to shape and disrupt industries around us, Johnson has kept a close eye on emerging startups and new investment opportunities. She understands that staying ahead of these changes is crucial for survival in such a competitive field. Through strategic investments in tech companies like Uber and Airbnb, Johnson has proven herself as a savvy investor with an eye for disruptive innovation.

Additionally, Johnson’s focus on diversity within both Fidelity Investments’ workforce and their portfolio companies also sets her apart from other leaders in VC firms dominated by men. She recognizes the importance of different perspectives when making investment decisions and actively works towards creating a more inclusive environment within the industry.

Overall, Abigail Johnson’s journey serves as an inspiration for aspiring leaders in venture capitalism – showcasing how determination coupled with adaptability can lead to great success in this ever-evolving field.

Examining Fidelity Investments Under Abigail Johnson’s Leadership

Abigail Johnson, a name synonymous with financial stewardship, took over the reins of Fidelity Investments from her father in 2014. Since then, she has shaped and guided the company to stay relevant and competitive in an ever-evolving marketplace. Johnson’s leadership is marked by tenaciousness; she faces challenges head-on while navigating Fidelity through economic uncertainties. Her dedication to innovation is evident through the firm’s expansion into new arenas like artificial intelligence, virtual reality, and cryptocurrencies.

Under Abigail’s leadership,

- The introduction of zero-fee index funds: This was a game-changer that managed to disrupt the industry norm. It not only attracted large volumes of new investors but also signaled a shift towards affordable investing.

- Digital transformation: Abigail envisaged digitalization as crucial for business sustainability long before it became an industry trend. By integrating technology into every aspect of their services, Fidelity offers seamless customer experiences today.

- Bolstering female participation: As one of few women at the helm in finance sector leadership roles, she has made significant strides towards promoting gender balance within Fidelity.

Johnson’s forward-thinking approach coupled with a deep understanding of market dynamics ensures that Fidelity remains stable yet flexible enough to seize emerging opportunities.

+

Read also: List of mergers and acquisitions by Delta airline

Abigail Johnson’s Investment Philosophy and its Influence on Venture Capital

Abigail Johnson’s investment philosophy is undeniably influential, shaping the venture capital landscape in remarkable ways. She heads Fidelity Investments, a multinational financial services corporation and has earned a reputation for her unique approach towards investments. A firm believer that successful investing requires patience and long-term thinking, she emphasizes on having deep knowledge about the companies before making any financial commitments rather than chasing quick gains.

At the heart of her philosophy are three key tenets: meticulous research, risk assessment, and sustained commitment.

- Meticulous Research: Abigail insists on in-depth understanding of all aspects of potential investment opportunities.

- Risk Assessment: Understanding potential risks is vital to make informed decisions. For Abigail, it’s better to avoid high-risk ventures unless they offer substantial returns.

- Sustained Commitment: Lastly, she advocates for sustained commitment over short term speculation. This makes one not just an investor but also a partner who’s invested in the company’s growth journey.

Her clear vision influences numerous venture capitalists by offering them fruitful strategies that pave way for their success in this unpredictable ecosystem inhabited by startups.

Incorporating these principles can decrease chances of failed investments – saving money while elevating profits considerably. Thusly so, Abigail Johnson’s investment methodology sets new standards to modern-day venture capitalism while shaping decision-making processes effectively across boardrooms worldwide. Her contributions continue to provide valuable insights guiding future trends within this dynamic field.

Venture Capital Trends: Abigail Johnson’s Predictions for the Future

Abigail Johnson, the esteemed CEO of Fidelity Investments, has made some intriguing predictions about future trends in venture capital. In her insight-driven view, emerging technologies will continue to vacate a substantial space in the venture capital sphere and she specifically emphasises on artificial intelligence (AI) and blockchain as significant players.

According to Johnson, “Artificial Intelligence is not just a tech term anymore. It’s making waves globally by enhancing operational efficiency and opening up new vistas.” She sees immense potential for AI startups in sectors ranging from healthcare to finance, offering smart solutions that can revolutionize traditional processes. The startup ecosystem looks promising with brilliant minds pushing boundaries and bringing forth innovative ideas that attract massive venture funding.

Another aspect Abigail dares to put her stakes on is the power of blockchain technology.

She believes this decentralized ledger system holds untapped potential which financial institutions could leverage for seamless transactions; eliminating intermediaries while bolstering security aspects. Her optimism towards blockchain reflects through Fidelity’s own launch of a standalone company dedicated to bringing digital assets into mainstream investment portfolios.

Noteworthy points from Abigail’s prediction include:

- An increasing focus on Artificial Intelligence startups.

- The adoption of Blockchain technology by financial institutions.

- Huge Venture Capital funding flowing into these high-tech businesses.

Avidly tracking these trends alongside other key observations underlies her success as an impactful leader within the global finance industry.

Abigail Johnson on venture capital

Abigail Johnson on venture capital

You may also like: joint ventures in Transportation Engineering industry

Overcoming Challenges in Venture Capital: Insights from Abigail Johnson

Abigail Johnson, the CEO of Fidelity Investments, is a titan in the venture capital world. Overcoming challenges with an elegant grace and relentless determination, she’s a beacon for anyone navigating this turbulent industry. Her journey contains invaluable lessons that can shed light on how to tackle hurdles head-on in the venture capital landscape.

Johnson began her career at a time when women were underrepresented in finance.

Breaking through this initial barrier was only one of many obstacles she faced along her path. One key insight from Johnson’s journey is the importance of resilience and adaptability when facing adversity. In an unstable market characterized by risk, these traits are paramount.

- She consistently proved herself able to forecast market trends accurately.

- Even during economic downturns, she remained steadfastly committed to making smart investments based on rigorous research.

- Her ability to maintain calm under pressure has been instrumental in her success.

In addition, Johnson emphasizes transparency as an essential component within VC firms for maintaining investor trust. Recognizing that every investment carries some level of risk,

she found it crucial always to communicate openly about potential pitfalls as well as promising opportunities.

- This honest approach bolstered confidence among clients and facilitated stronger relationships.

- The notion that openness fosters trust continues to be foundational within Fidelity Investments under her leadership.

No matter what challenges lie ahead, drawing from Abigail Johnson’s insights can strengthen any strategy within venture capital.

Conclusion: Lessons Learned from Abigail Johnson on Venturing into the World of VC.

Abigail Johnson, a prominent figure in the realm of venture capitalism, has shared valuable enlightenment that can be an excellent guiding light for anyone considering venturing into this exhilarating world. Her journey teems with crucial insights and lessons that have shaped her success story. Here are some standout nuggets from Abigail’s wealth of knowledge:

- ‘Failure is inevitable.’ She underlines the importance of accepting failure as a stepping stone rather than an end. It’s all about learning from these missteps.

- ‘Invest in people.’ Investing shouldn’t just be about potential profits but also people involved in driving those profits, their passion and determination.

- ‘Patience pays.’ The nature of VC means it requires patience to see investments bear fruit; instant gratification seldom exists here.

Delving deeper into Johson’s wisdom, she emphasizes maintaining integrity throughout one’s career path. “Ethics over earnings“, is what she advocates for – honoring commitments made to investors and ensuring transparency at all times which fosters trust.

In addition, risk-assessment forms another cornerstone of her approach towards venture capital investment. It’s not just about taking risks but making calculated ones – understanding market trends, evaluating business models thoroughly before plunging headlong into investments.

The most significant takeaway remains: venture capitalism isn’t merely a field, it’s an art mastered by meticulous planning and execution mixed with bold decision-making abilities.

Read also: difference between private equity and venture capital